File & Pay

Your 3rd Quarter Tax Returns

in Just 3 Days…

ikaw mismo.

Kahit confused ka sa tax type...

Kahit hindi mo alam yung BIR forms at deadlines…

Kahit takot ka magkamali at ma-penalty…

Kahit newbie ka at zero accounting background…

You can learn, file, and pay your

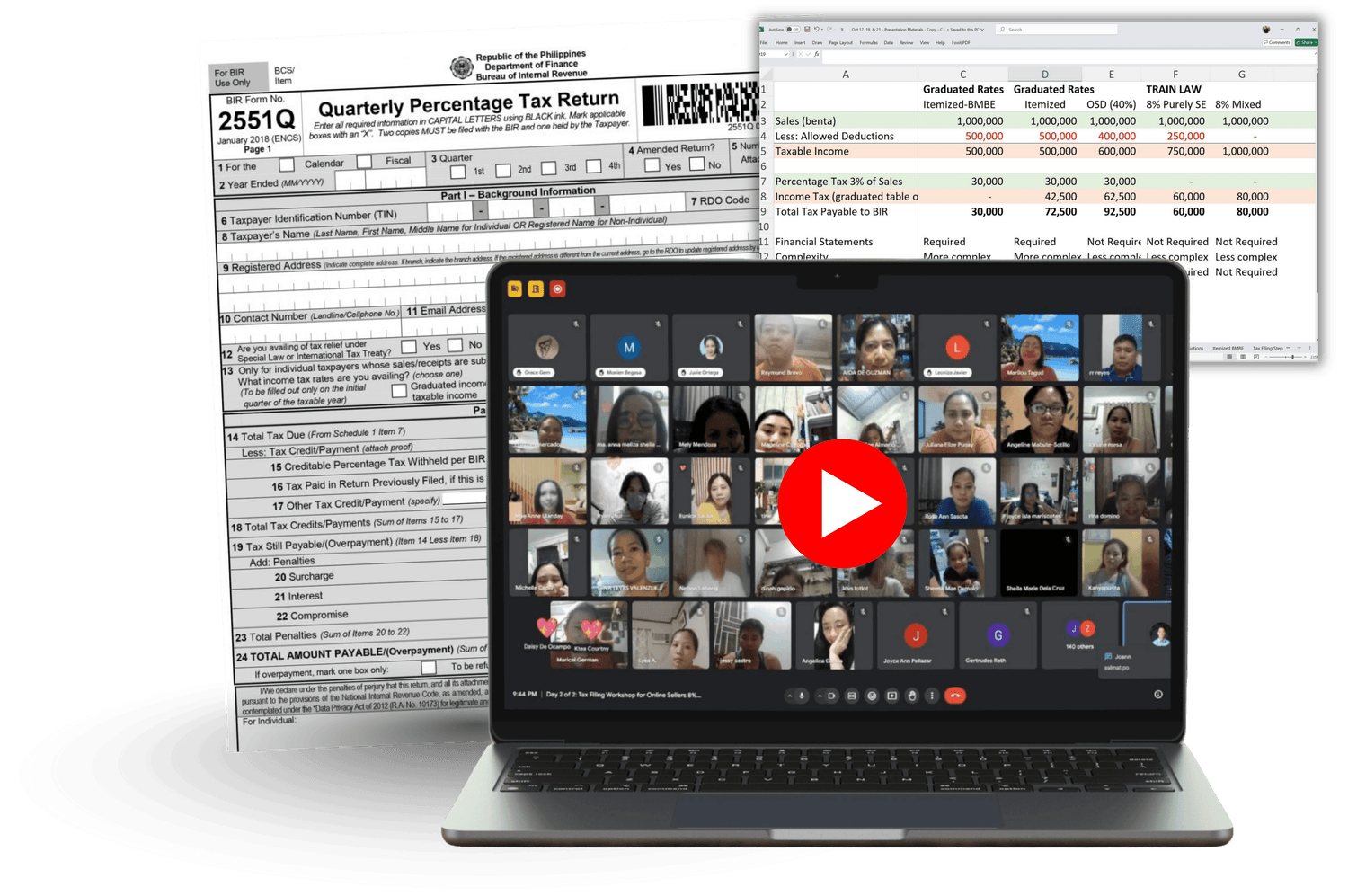

2551Q, 1701Q, SAWT, and eAFS, step-by-step,

on time, with my guidance.

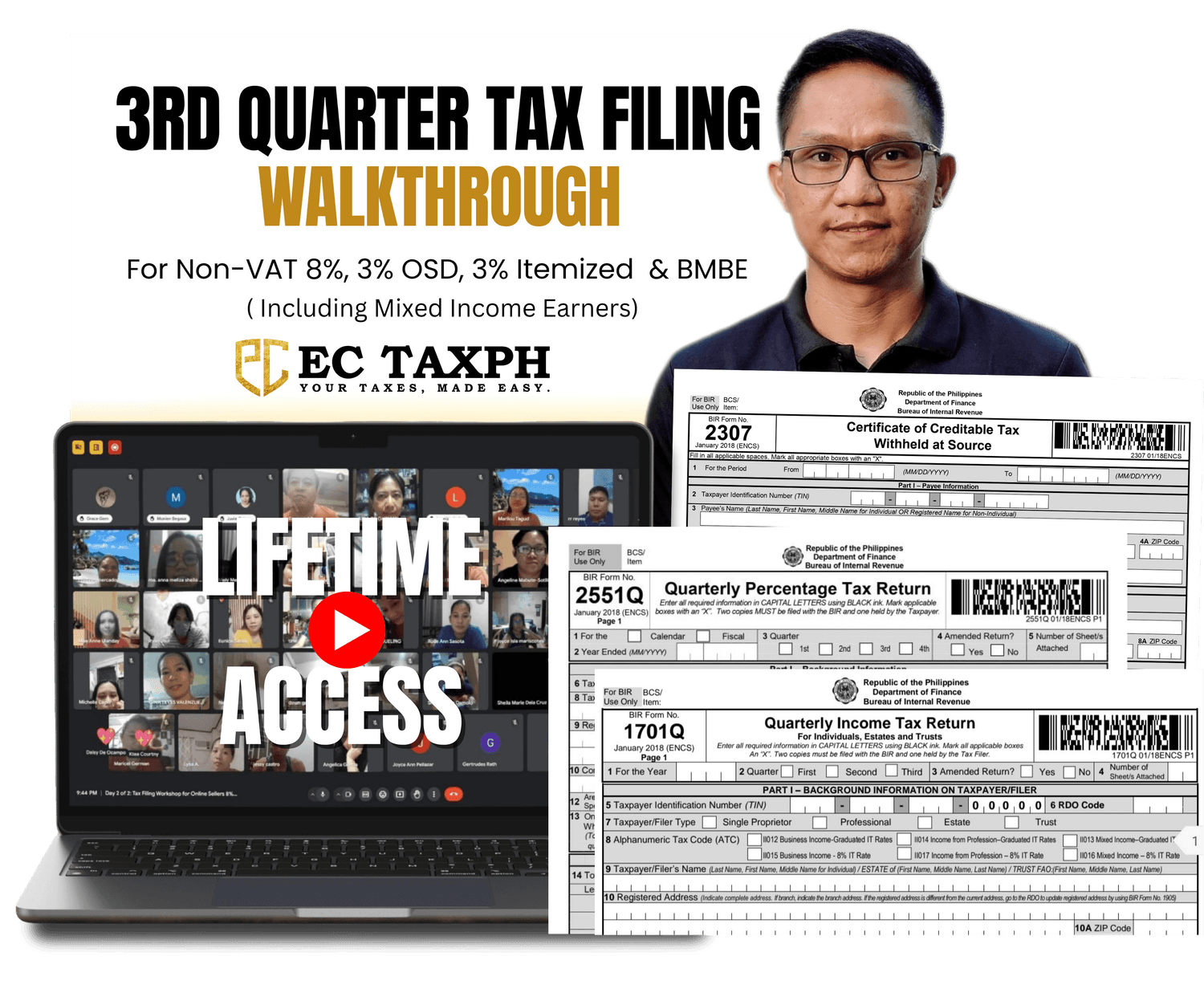

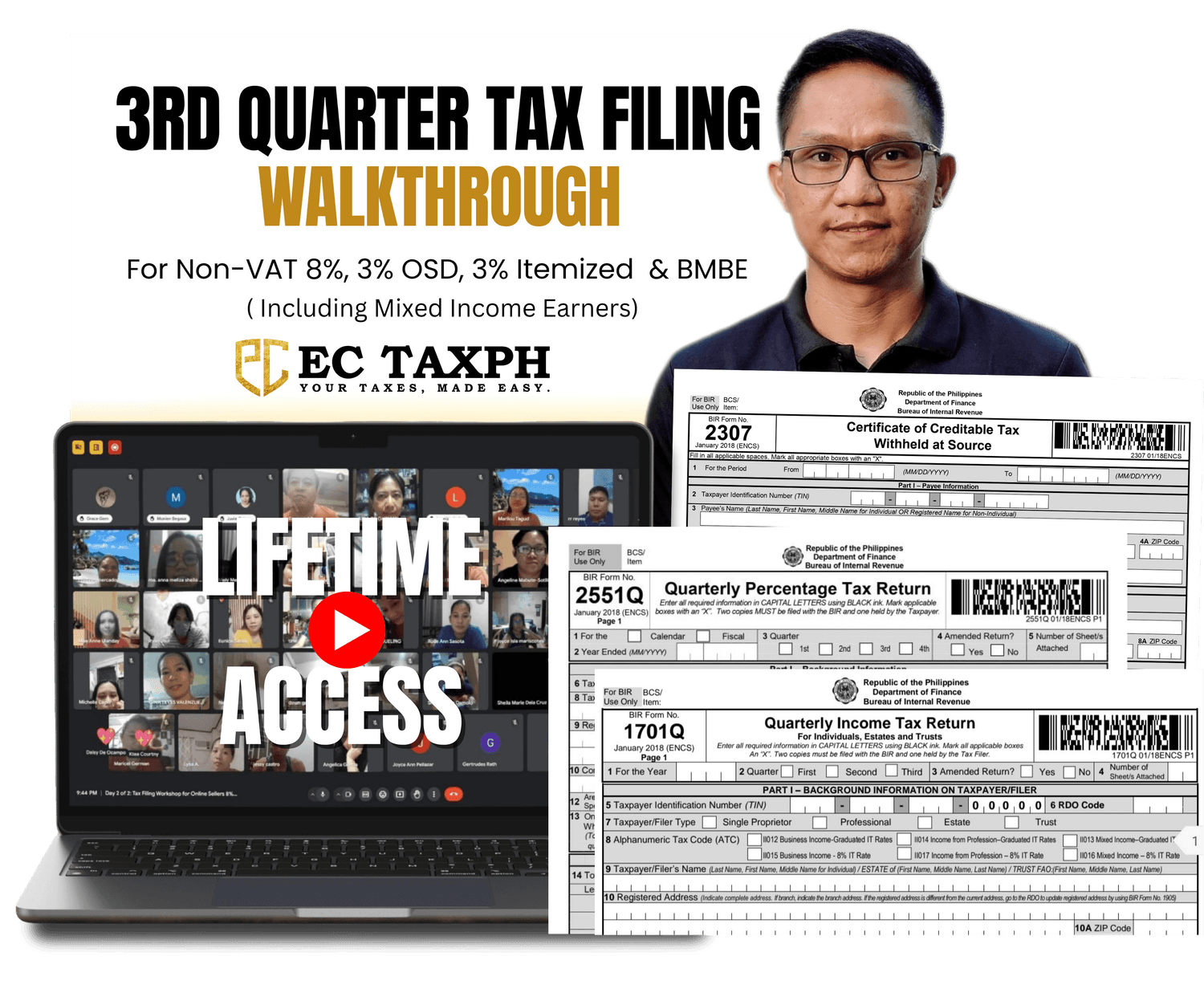

Get lifetime access to the recordings of my

𝟯𝗥𝗗 𝗤𝗨𝗔𝗥𝗧𝗘𝗥 𝗧𝗔𝗫 𝗙𝗜𝗟𝗜𝗡𝗚 𝗪𝗔𝗟𝗞𝗧𝗛𝗥𝗢𝗨𝗚𝗛

(last Oct 17, 19, & 21)

for Non-VAT 8%, 3% OSD, and 3% Itemized (including BMBE & Mixed Income Earners)

Beat the BIR deadlines and avoid penalties

(minimum ₱1,000 per tax return + 10% surcharge + 6% yearly interest)..

Kahit confused ka sa tax type.

Kahit hindi mo alam yung BIR forms at deadline.

Kahit takot ka magkamali at ma-penalty.

Kahit newbie ka at zero accounting background.

You can learn, file, and pay your

2551Q, 1701Q, SAWT, and eAFS,

step-by-step, on time,

with my guidance.

File & Pay

Your 3rd Quarter

Tax Returns

in Just 3 Days

ikaw mismo...

Get lifetime access to the recordings of my

𝟯𝗥𝗗 𝗤𝗨𝗔𝗥𝗧𝗘𝗥 𝗧𝗔𝗫 𝗙𝗜𝗟𝗜𝗡𝗚 𝗪𝗔𝗟𝗞𝗧𝗛𝗥𝗢𝗨𝗚𝗛

(last Oct 17, 19, & 21)

for Non-VAT 8%, 3% OSD, and 3% Itemized (including BMBE & Mixed Income Earners)

Beat the BIR deadlines

and avoid penalties

(minimum ₱1,000 per tax return + 10% surcharge + 6% yearly interest)..

Alam ko yung feeling…

Yung hindi mo alam saan magsisimula, tapos iba-iba sinasabi sa BIR, TikTok, YouTube, at FB groups.

The more you read, the more you search,

the more you ask, mas lalo nagiging magulo.

May nagsasabi ng ganito,

may nagsasabi ng iba.

May deadline pa.

May penalty pa.

At sa dulo, ikaw pa rin mag-isa ang magpa-file.

Kung pwede lang sana, ipagawa mo nalang sa iba… pero hindi mo pa kaya mag-hire ng bookkeeper or accountant, kasi ang mahal at nagsisimula ka palang.

Tapos feeling mo, mag-isa ka at walang mapagtanungan.

Nakaka-overwhelm.

Nakaka-stress.

Nakakatakot magkamali.

And that’s exactly why I created this walkthrough.

Para may malinaw kang susundan, step-by-step, parang hawak ko yung kamay mo sa bawat click, hanggang matapos mo yung filing nang maayos, on time, at walang kaba.

Para kanino ang

3RD QUARTER TAX FILING WALKTHROUGH

(Recording Access)?

Micro Online Sellers & Freelancers

Tax type na Non-VAT 8%, 3% OSD, or 3% Itemized (including BMBE & Mixed Income Earners).

May annual sales na Php 3 Million or less per year.

Wala pang budget sa monthly fee ng accountant or bookkeeper.

Gusto maka-save ng at least Php 2,500/month sa retainers fee.

Willing to learn, coachable, and enjoys challenges.

Alam ko yung feeling…

Yung hindi mo alam saan magsisimula, tapos iba-iba sinasabi sa BIR, TikTok, YouTube, at FB groups.

The more you read, the more you search, the more you ask, mas lalo nagiging magulo.

May nagsasabi ng ganito,

may nagsasabi ng iba.

May deadline pa.

May penalty pa.

At sa dulo, ikaw pa rin mag-isa ang magpa-file.

Kung pwede lang sana, ipagawa mo nalang sa iba… pero hindi mo pa kaya mag-hire ng bookkeeper or accountant, kasi ang mahal at nagsisimula ka palang.

Tapos feeling mo, mag-isa ka at walang mapagtanungan.

Nakaka-overwhelm.

Nakaka-stress.

Nakakatakot magkamali.

And that’s exactly why I created this walkthrough.

Para may malinaw kang susundan, step-by-step, parang hawak ko yung kamay mo sa bawat click, hanggang matapos mo yung filing nang maayos, on time, at walang kaba.

Para kanino ang

3RD QUARTER TAX FILING WALKTHROUGH

(Recording Access)?

Micro Online Sellers & Freelancers

Tax type na Non-VAT 8%, 3% OSD, or 3% Itemized (including BMBE & Mixed Income Earners).

May annual sales na Php 3 Million or less per year.

Wala pang budget sa monthly fee ng accountant or bookkeeper.

Gusto maka-save ng at least Php 2,500/month sa retainers fee.

Willing to learn, coachable, and enjoys challenges.

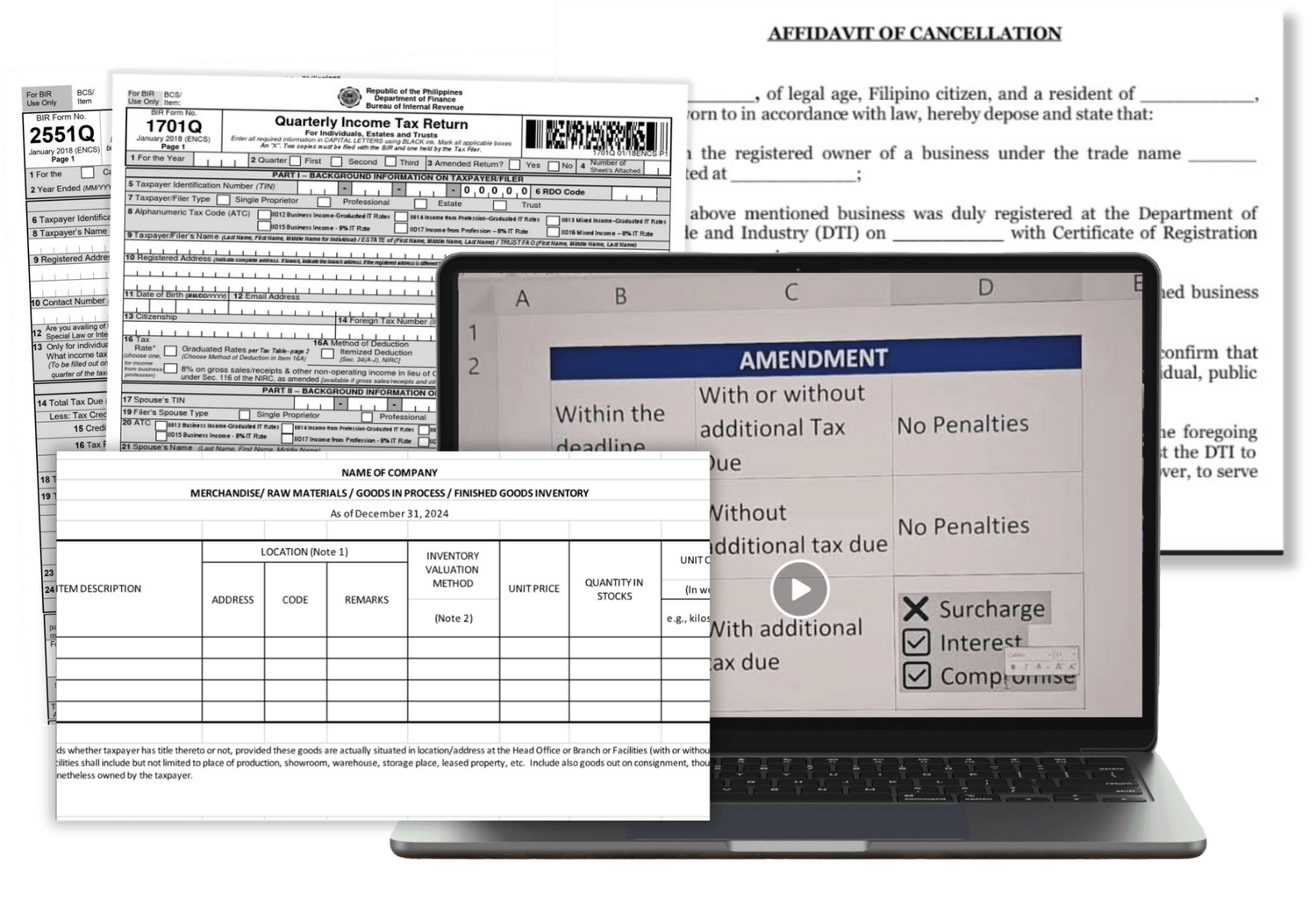

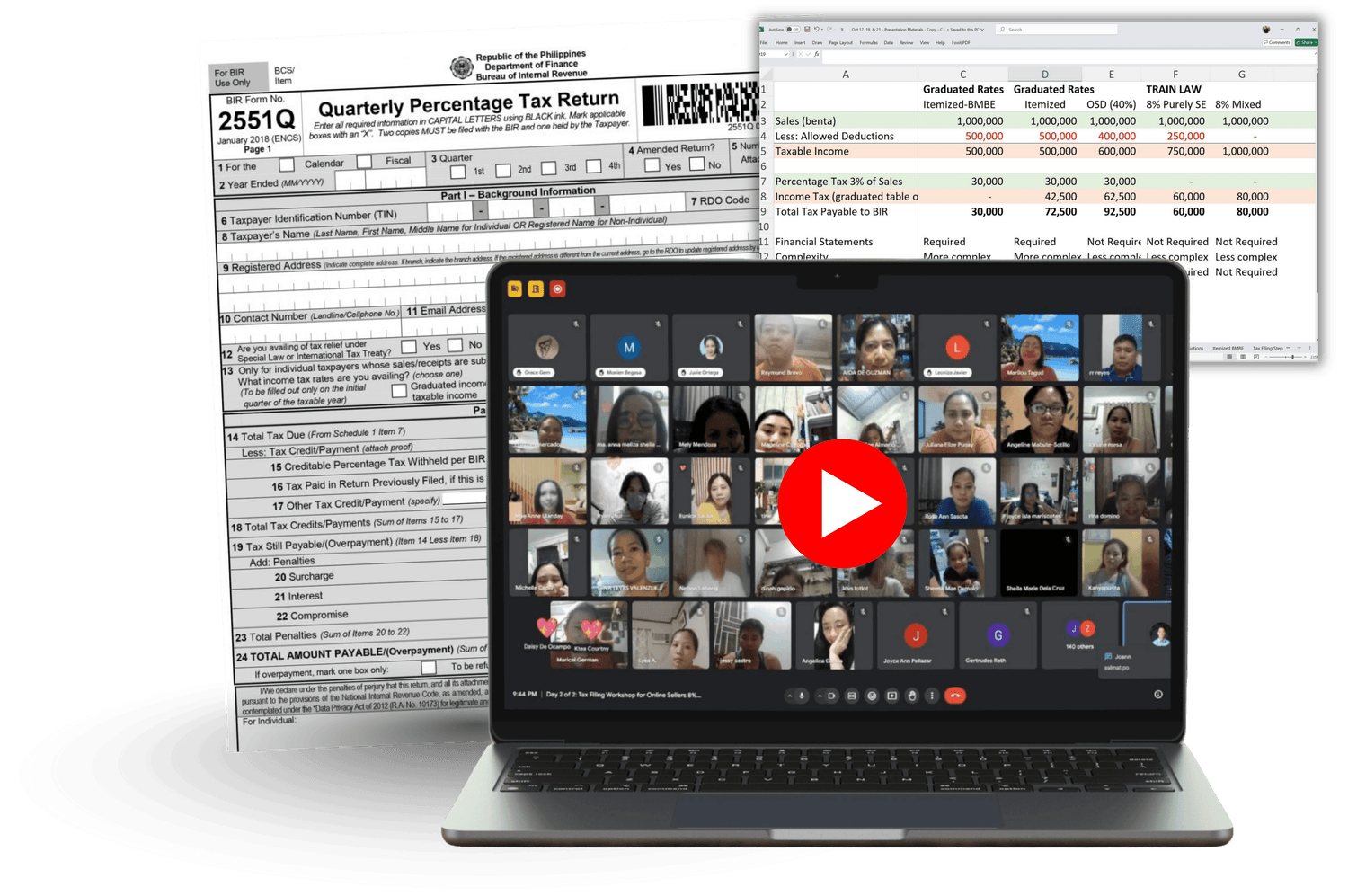

Ano yung mga

matututunan mo?

DAY 1

Ano yung mga upcoming tax deadlines, para makapag-file & pay ka on time at iwas penalty.

Ano yung correct sales na dapat i-declare kay BIR, para hindi sobra or hindi kulang yung tax na babayaran mo.

Paano mag-file ng 3rd Quarter 2551Q.

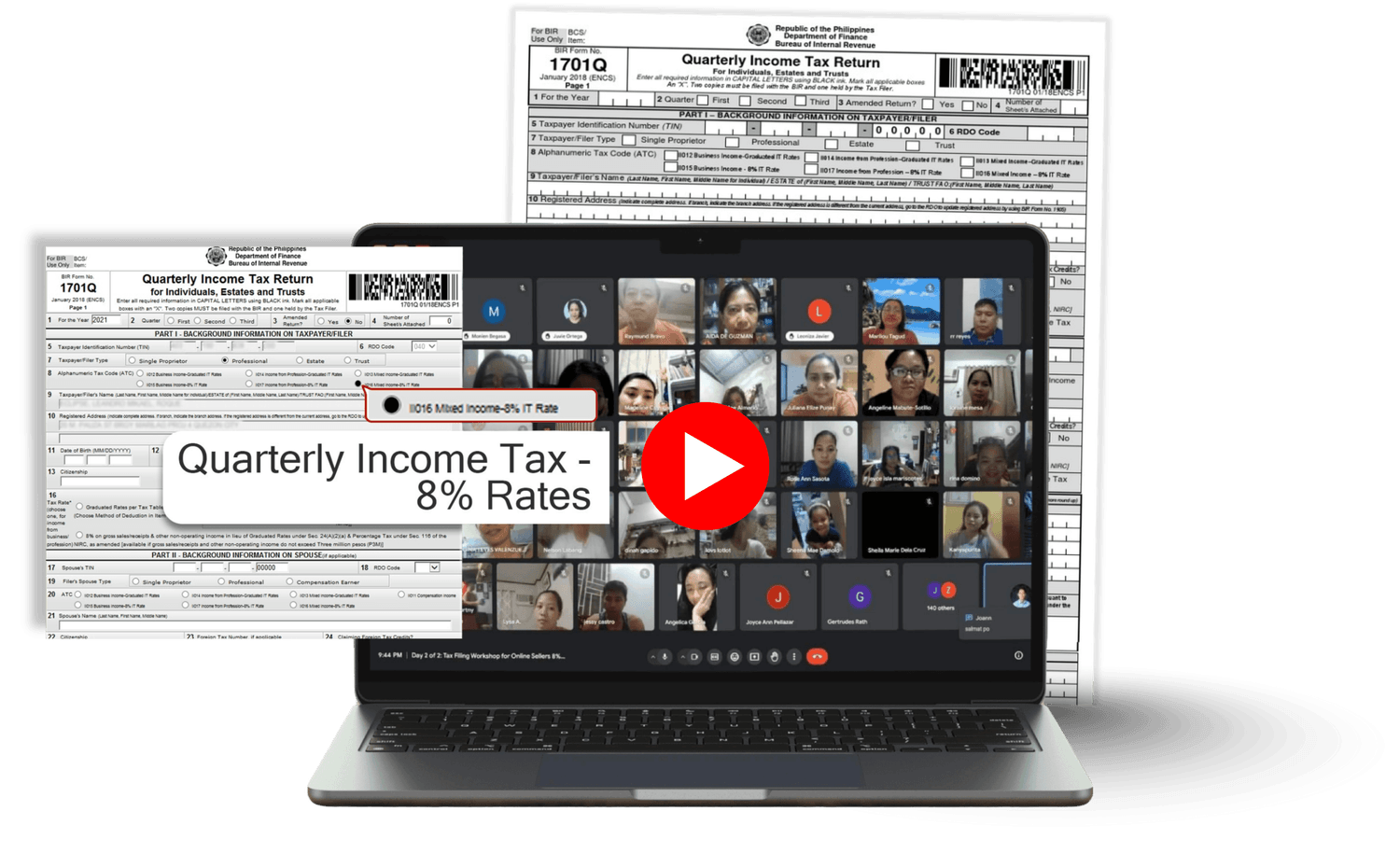

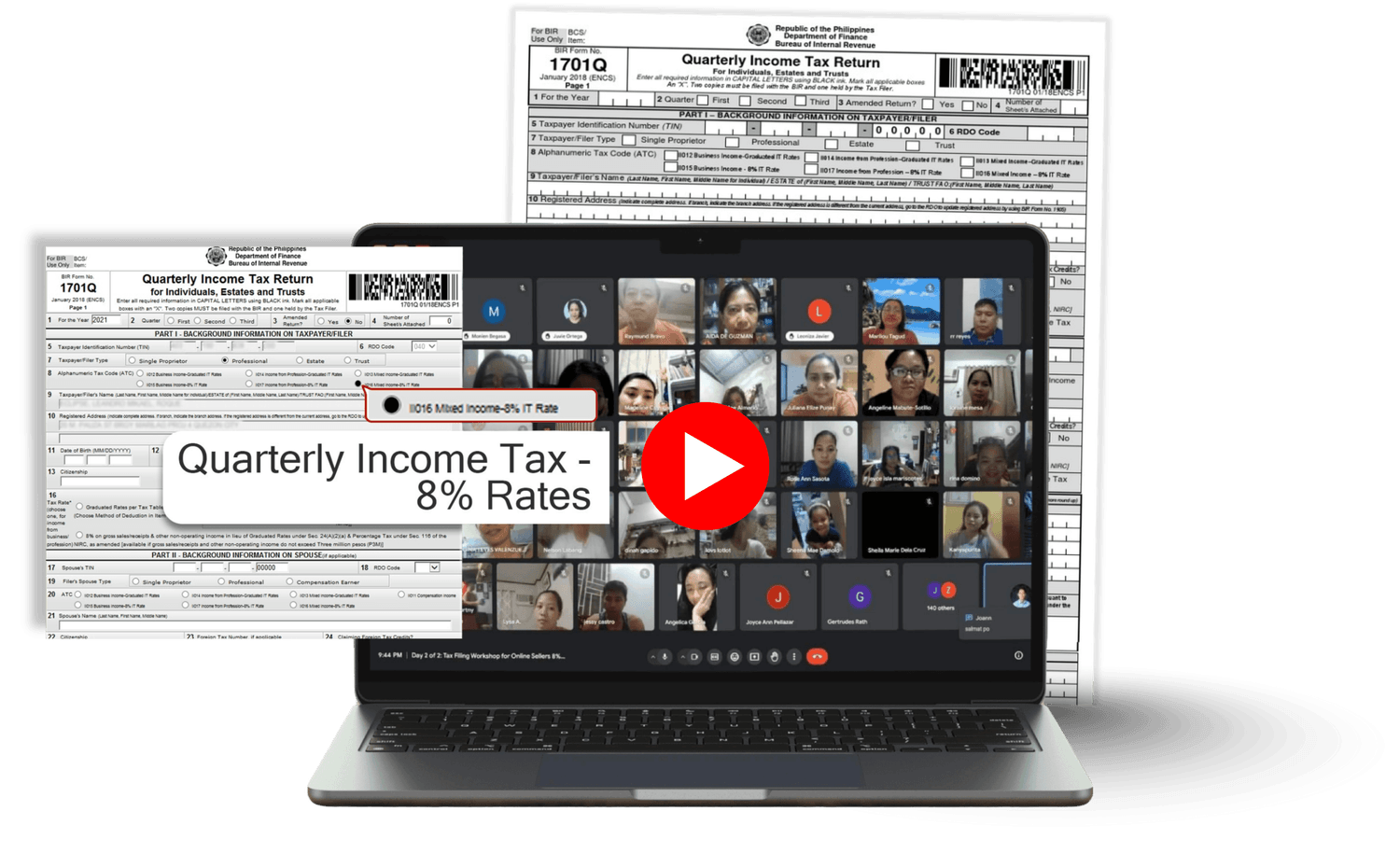

DAY 2

Paano mag-file ng 3rd Quarter 1701Q for Non-VAT 8% & mixed income earners, in 3-easy steps, kahit newbie ka.

How to file 3rd Quarter 1701Q for Non-VAT 3% OSD & mixed income earners.

How to file 3rd Quarter 1701Q for Non-VAT Itemized Deductions & BMBE, including mixed income earners.

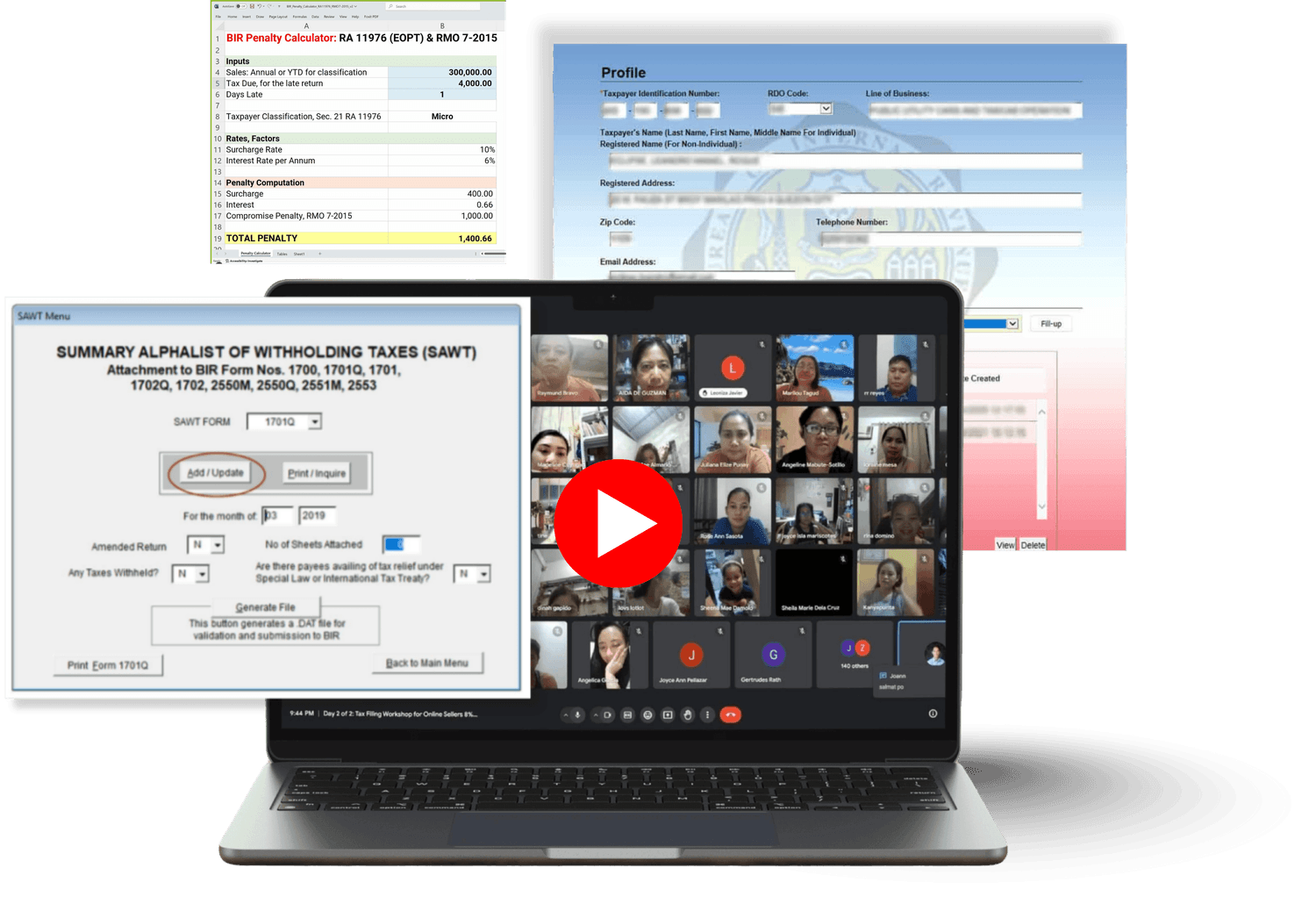

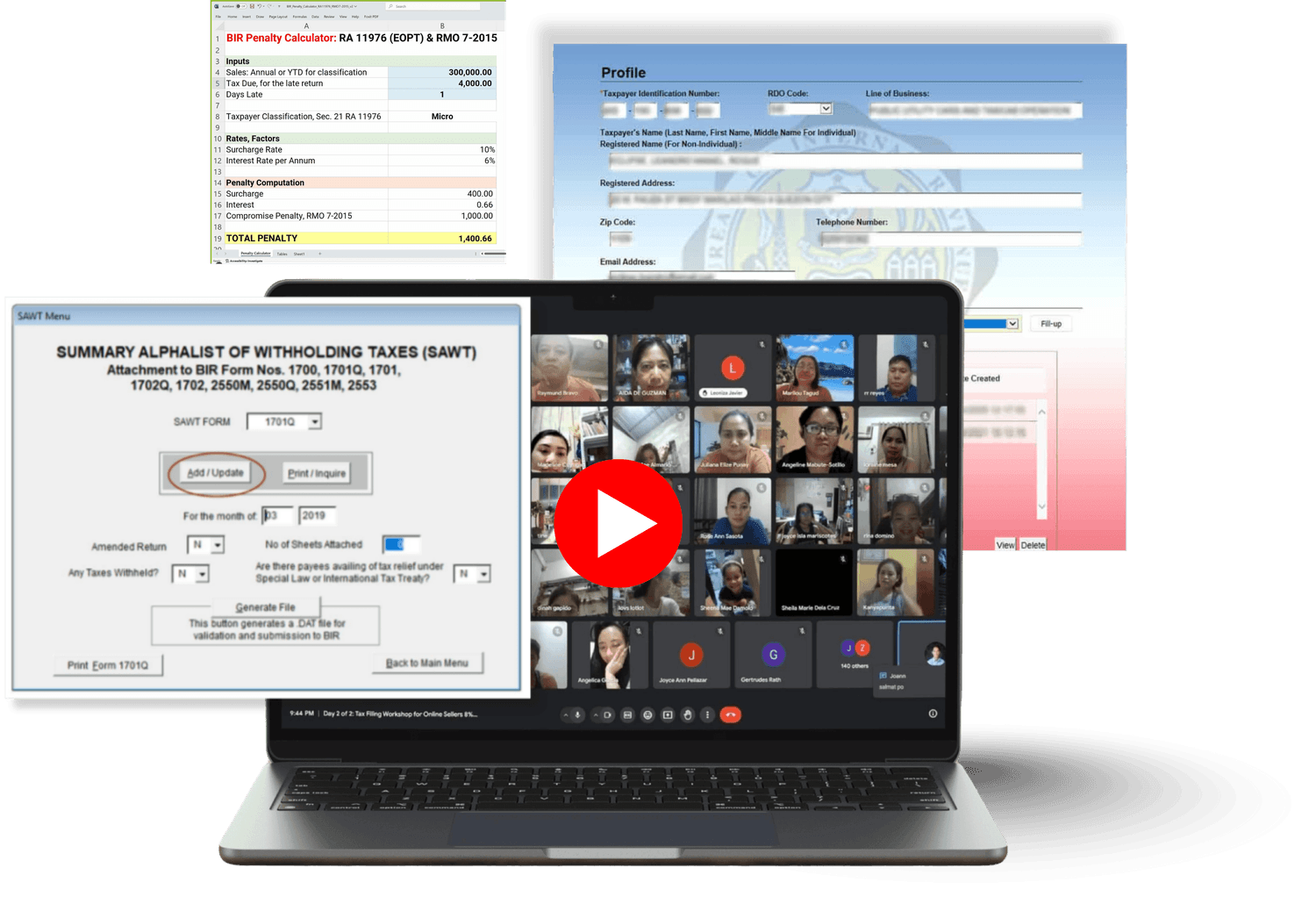

DAY 3

How to claim withholding tax credits and submit 2307 via SAWT eSubmission & eAFS para legally mabawasan yung income tax payable mo kay BIR.

How to compute penalties for late filing and how much is the surcharge, interest, and compromise penalties.

SUMMARY OF

3RD QUARTER DEADLINES:

Oct 25 – 2551Q (Percentage Tax)

Nov 15 – 1701Q + SAWT 2307, if applicable

Nov 30 – eAFS, if applicable

Kapag hindi mo ito na-file on time:

₱1,000 minimum compromise penalty per unfiled return

10% surcharge kung may tax payable

6% annual interest palaki nang palaki over time

Kaya mahirap at magastos magkamali.

At pinaka-masakit…

yung wala ka na ngang kinita, may penalty kapa.

Pero kung alam mo ang tamang gagawin, maiiwasan lahat ‘yan.

BONUS LESSONS

Newbie

Bonus Lessons

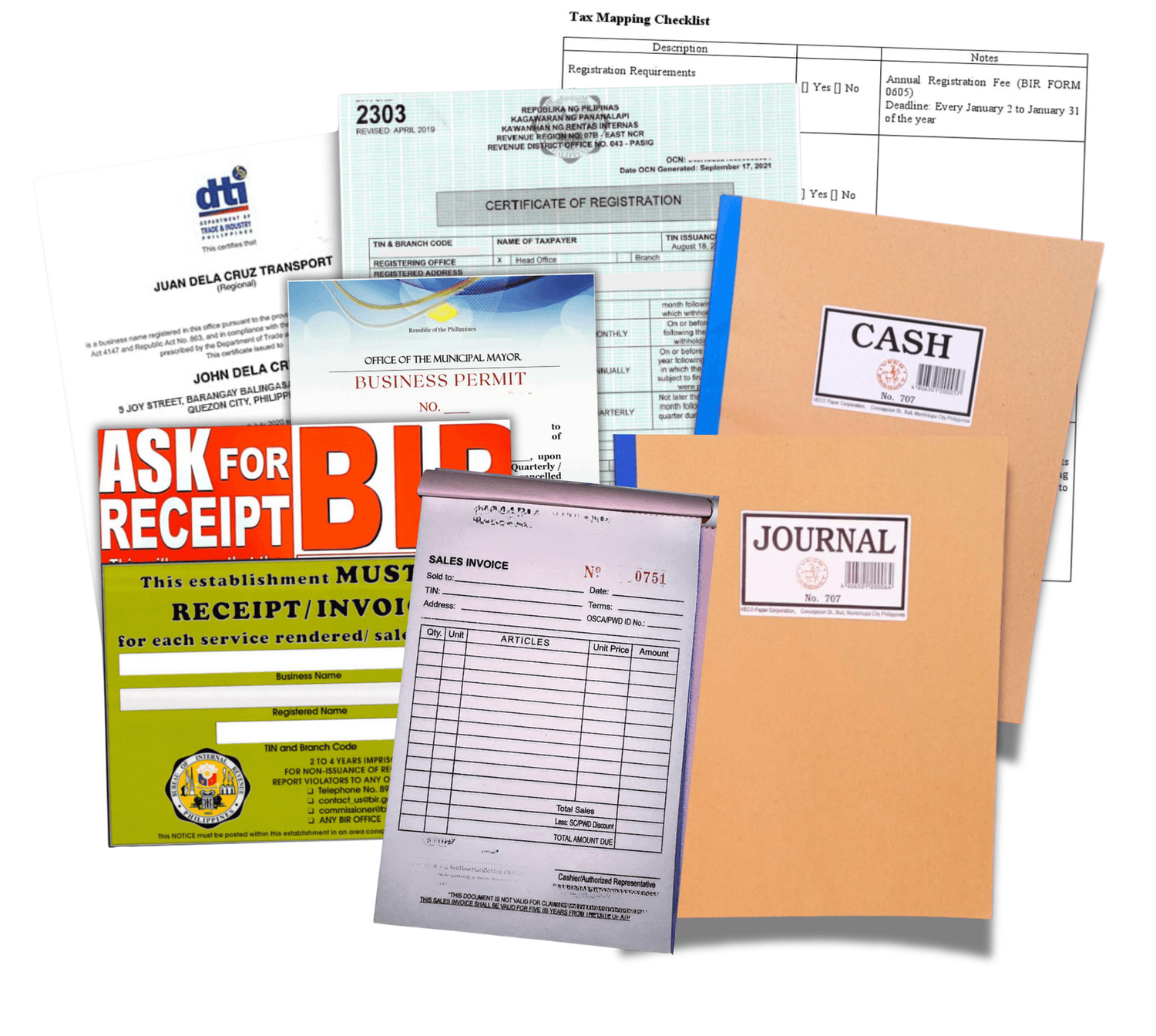

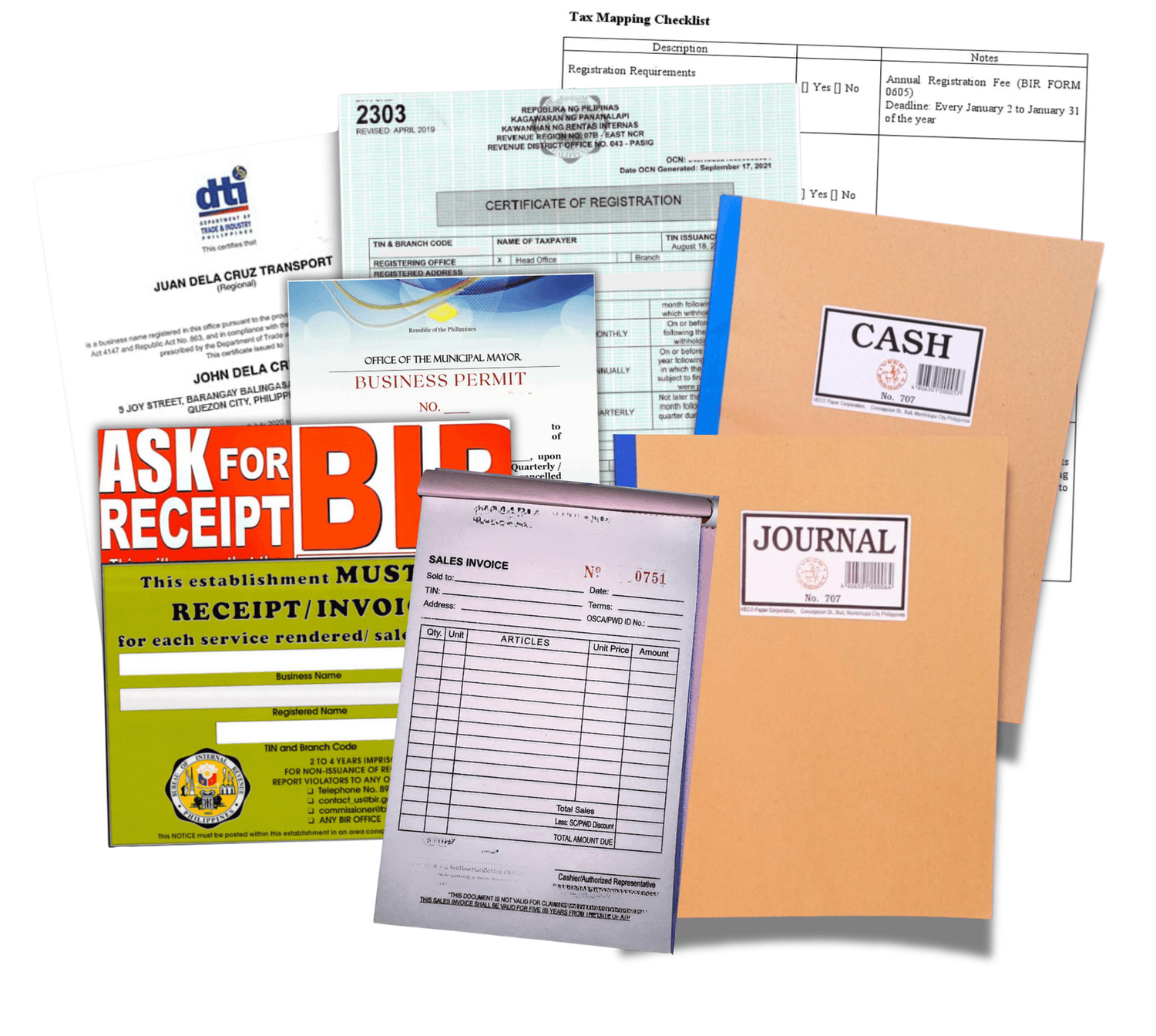

Paano mag-register ng business (DTI, BIR, BMBE, LGU, ATP, ORUS, & Trustmark).

Anong tax type yung magandang piliin para makatipid sa tax: 8%, 3% OSD, or 3% Itemized/BMBE? Paano mag-update ng tax type?

Invoicing: Paano magsulat sa Sales or Service Invoice.

Bookkeeping: Paano magsulat ng sales sa Cash Receipt Book & General Journal.

Tax mapping & BIR Audit tips

Advanced

Bonus Lessons

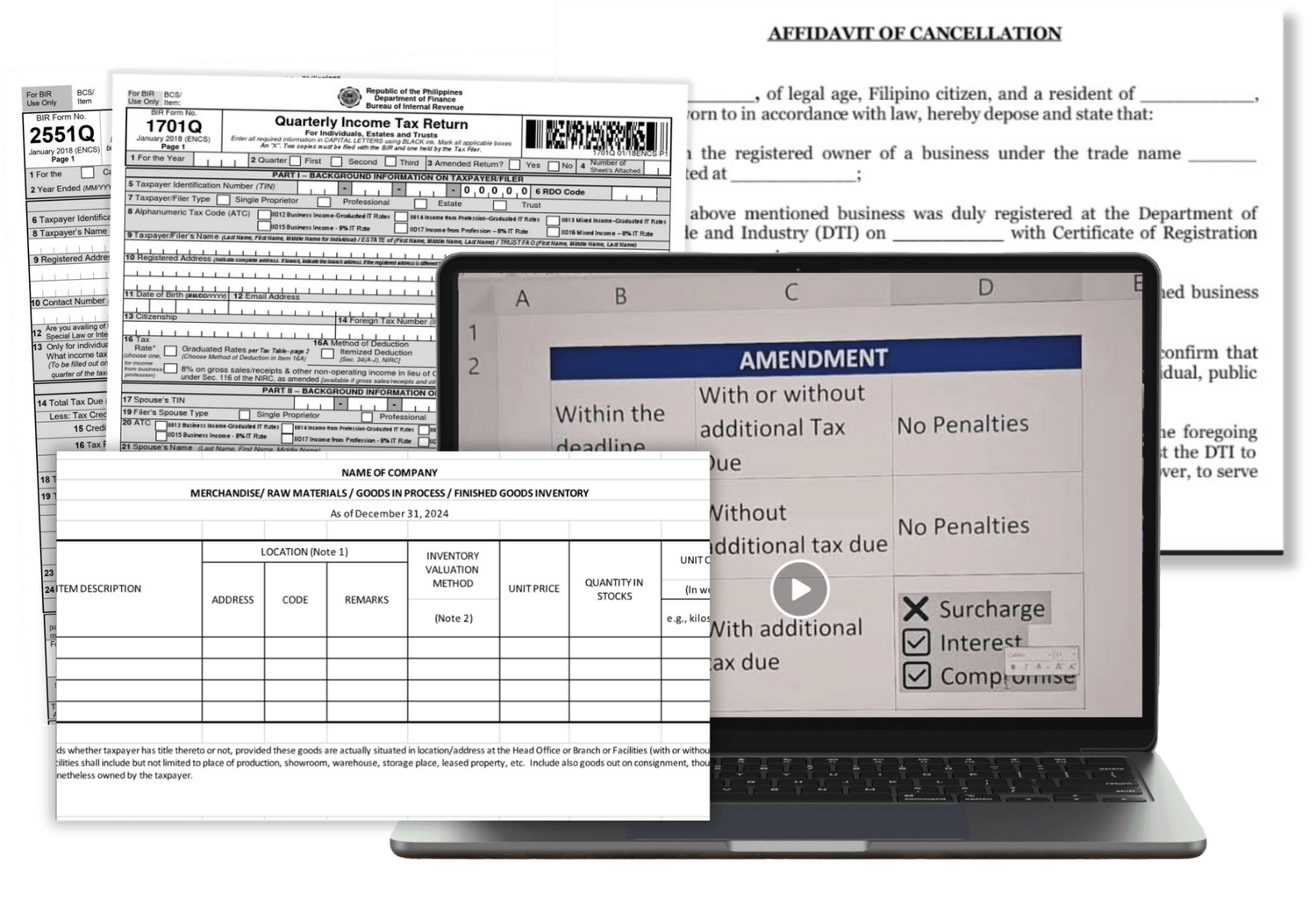

Inventory List Submission, Business Closure, & Open case monitoring

Sworn Declaration of Gross Remittance for online sellers

Sworn Declaration of Gross Sales for freelancers, professionals and affiliates

How to amend 3rd quarter 2551Q & 1701Q?

Ano yung mga matututunan mo?

DAY 1

Ano yung mga upcoming tax deadlines, para makapag-file & pay ka on time at iwas penalty.

Ano yung correct sales na dapat i-declare kay BIR, para hindi sobra or hindi kulang yung tax na babayaran mo.

Paano mag-file ng 3rd Quarter 2551Q.

DAY 2

Paano mag-file ng 3rd Quarter 1701Q for Non-VAT 8% & mixed income earners, in 3-easy steps, kahit newbie ka.

How to file 3rd Quarter 1701Q for Non-VAT 3% OSD & mixed income earners.

How to file 3rd Quarter 1701Q for Non-VAT Itemized Deductions & BMBE, including mixed income earners.

DAY 3

How to claim withholding tax credits and submit 2307 via SAWT eSubmission & eAFS para legally mabawasan yung income tax payable mo kay BIR.

How to compute penalties for late filing and how much is the surcharge, interest, and compromise penalties.

SUMMARY OF

3RD QUARTER DEADLINES:

Oct 25 – 2551Q (Percentage Tax)

Nov 15 – 1701Q + SAWT 2307, if applicable

Nov 30 – eAFS, if applicable

Kapag hindi mo ito na-file on time:

₱1,000 minimum compromise penalty per unfiled return

10% surcharge kung may tax payable

6% annual interest palaki nang palaki over time

Kaya mahirap at magastos magkamali.

At pinaka-masakit…

yung wala ka na ngang kinita, may penalty kapa.

Pero kung alam mo ang tamang gagawin, maiiwasan lahat ‘yan.

BONUS LESSONS

Paano mag-register ng business (DTI, BIR, BMBE, LGU, ATP, ORUS, & Trustmark).

Anong tax type yung magandang piliin para makatipid sa tax: 8%, 3% OSD, or 3% Itemized/BMBE? Paano mag-update ng tax type?

Invoicing: Paano magsulat sa Sales or Service Invoice.

Bookkeeping: Paano magsulat ng sales sa Cash Receipt Book & General Journal.

Tax mapping & BIR Audit tips

Newbie

Bonus Lessons

Inventory List Submission, Business Closure, & Open case monitoring

Sworn Declaration of Gross Remittance for online sellers

Sworn Declaration of Gross Sales for freelancers, professionals and affiliates

How to amend 3rd quarter 2551Q & 1701Q?

Advanced

Bonus Lessons

How much is

the investment fee?

Yung total value ng 3rd Quarter Tax Filing Walkthrough Recordings + Bonus Lessons is:

Php 2,000 regular price

But, you can get 𝟱𝟱% 𝗱𝗶𝘀𝗰𝗼𝘂𝗻𝘁 𝘂𝗻𝘁𝗶𝗹 tonight 𝟭𝟭:𝟱𝟵𝗣𝗠 𝗼𝗻𝗹𝘆.

For only Php 899

(save Php 1,101).

You can learn all of these plus 𝗲𝘅𝗰𝗹𝘂𝘀𝗶𝘃𝗲 𝘀𝘂𝗽𝗽𝗼𝗿𝘁 where you can ask unlimited questions, anytime, until December 2025.

Parang 𝟮𝟵𝟵 𝗽𝗲𝘀𝗼𝘀 𝗽𝗲𝗿 𝗱𝗮𝘆 𝗹𝗮𝗻𝗴..

How much is the investment fee?

Yung total value ng 3rd Quarter Tax Filing Walkthrough Recordings

+ Bonus Lessons is:

Php 2,000 regular price

But, you can get 𝟱𝟱% 𝗱𝗶𝘀𝗰𝗼𝘂𝗻𝘁 𝘂𝗻𝘁𝗶𝗹 tonight 𝟭𝟭:𝟱𝟵𝗣𝗠 𝗼𝗻𝗹𝘆.

For only Php 899

(save Php 1,101).

You can learn all of these plus 𝗲𝘅𝗰𝗹𝘂𝘀𝗶𝘃𝗲 𝘀𝘂𝗽𝗽𝗼𝗿𝘁 where you can ask unlimited questions, anytime, until December 2025.

Parang 𝟮𝟵𝟵 𝗽𝗲𝘀𝗼𝘀 𝗽𝗲𝗿 𝗱𝗮𝘆 𝗹𝗮𝗻𝗴..

Paano mag-register?

If ready ka na mag-invest sa knowledge at matuto ng

3rd Quarter Tax Filing, here's how to access the recorded trainings in 2 easy steps:

Here's how to secure your slot.

STEP 1. Pay Php 899 only (save 55%).

You can pay via GCash or bank transfer here:

GCash

09173718664

ED••••O J• B

BPI

8830005073

EC TAXPH Business Consultancy

STEP 2. i-PM mo lang yung screenshot ng proof of payment sa EC TAXPH Facebook page.

IMPORTANT NOTE: 𝗪𝗲 𝘄𝗶𝗹𝗹 𝘃𝗲𝗿𝗶𝗳𝘆 𝘆𝗼𝘂𝗿 𝗽𝗮𝘆𝗺𝗲𝗻𝘁 𝘄𝗶𝘁𝗵𝗶𝗻

𝟮𝟰 𝗵𝗼𝘂𝗿𝘀 and 𝗽𝗹𝗲𝗮𝘀𝗲 𝘄𝗮𝗶𝘁 𝗳𝗼𝗿 𝗼𝘂𝗿 𝗿𝗲𝗽𝗹𝘆 para ma-assist ka namin papunta sa exclusive group.

Paano mag-register?

If ready ka na mag-invest sa knowledge at matuto ng

3rd Quarter Tax Filing,

here's how to access the recorded trainings in 2 easy steps:

Here's how to secure your slot.

STEP 1. Pay Php 899 only (save 55%).

You can pay via GCash or bank transfer here:

GCash

09173718664

ED••••O J• B

BPI

8830005073

EC TAXPH Business Consultancy

STEP 2. i-PM mo lang yung screenshot ng proof of payment sa EC TAXPH Facebook page.

IMPORTANT NOTE: 𝗪𝗲 𝘄𝗶𝗹𝗹 𝘃𝗲𝗿𝗶𝗳𝘆 𝘆𝗼𝘂𝗿 𝗽𝗮𝘆𝗺𝗲𝗻𝘁 𝘄𝗶𝘁𝗵𝗶𝗻 𝟮𝟰 𝗵𝗼𝘂𝗿𝘀 and 𝗽𝗹𝗲𝗮𝘀𝗲 𝘄𝗮𝗶𝘁 𝗳𝗼𝗿 𝗼𝘂𝗿 𝗿𝗲𝗽𝗹𝘆 para ma-assist ka namin papunta sa exclusive group.

Benefits kapag

nag-join ka dito

Lifetime access sa 3rd Quarter Tax Filing Walkthrough Recorded Trainings.

Lifetime access sa 1st & 2nd quarter tax filing webinar recordings and bonus lessons.

Extended December 2025 exclusive support group. Get invited to exclusive fb group, unli tanong, anytime. Our team will assist you within 24 hours, except weekends or holidays.

Attend series of exclusive live Q&A para mas solid yung learning mo.

Avoid tax mapping penalties ranging from 1k to 50k and become BIR audit ready.

Save at least Php 2,500/month retainers fee.

Be confident na makapag file at magbayad ng tax mo, ikaw mismo, kahit walang guide ng accountant.

Be confident na makapag file at magbayad ng tax mo, ikaw mismo, kahit walang guide ng accountant.

Natuto ka na,

compliant ka pa,

at nakatipid ka pa.

Wait, there's more...

you will also get these

Downloadable TOOLS AND

TEMPLATES for FREE

Books of Accounts: Cash receipt book, Cash disbursement book, General Journal, General Ledger

Financial Statements & Worksheet

EC TAX CALCULATOR to help you save at least Php 7,500 in taxes per year. Click here to watch the demo.

Inventory List (Annex A & Annex D)

Sworn Declaration on Gross Remittance (Annex A) - for online sellers

Sworn Declaration of Gross Sales (for freelancers, professionals, and affiliates)

Tax Deadlines para hindi mo malimutan mag-file at hindi ka magka open case penalty.

Penalty Calculator para in case late filing ka, alam mo kung magkano yung babayaran mo.

HOT BONUS: EC SAWT Excel File, no need na mag alphalist data entry! Validate nalang!

Benefits kapag

nag-join ka dito

Lifetime access sa 3rd Quarter Tax Filing Walkthrough Recorded Trainings.

Lifetime access sa 1st & 2nd quarter tax filing webinar recordings and bonus lessons.

Extended December 2025 exclusive support group. Get invited to exclusive fb group, unli tanong, anytime. Our team will assist you within 24 hours, except weekends or holidays.

Attend series of exclusive live Q&A para mas solid yung learning mo.

Avoid tax mapping penalties ranging from 1k to 50k and become BIR audit ready.

Save at least Php 2,500/month retainers fee.

Be confident na makapag file at magbayad ng tax mo, ikaw mismo, kahit walang guide ng accountant.

Be confident na makapag file at magbayad ng tax mo, ikaw mismo, kahit walang guide ng accountant.

Natuto ka na,

compliant ka pa,

at nakatipid ka pa.

Wait, there's more...

you will also get these

Downloadable TOOLS AND TEMPLATES for FREE

Books of Accounts: Cash receipt book, Cash disbursement book, General Journal, General Ledger

Financial Statements & Worksheet

EC TAX CALCULATOR to help you save at least Php 7,500 in taxes per year.

Inventory List (Annex A & Annex D)

Sworn Declaration on Gross Remittance (Annex A) - for online sellers

Sworn Declaration of Gross Sales (for freelancers, professionals, and affiliates)

Tax Deadlines para hindi mo malimutan mag-file at hindi ka magka open case penalty.

Penalty Calculator para in case late filing ka, alam mo kung magkano yung babayaran mo.

HOT BONUS: EC SAWT Excel File, no need na mag alphalist data entry! Validate nalang!

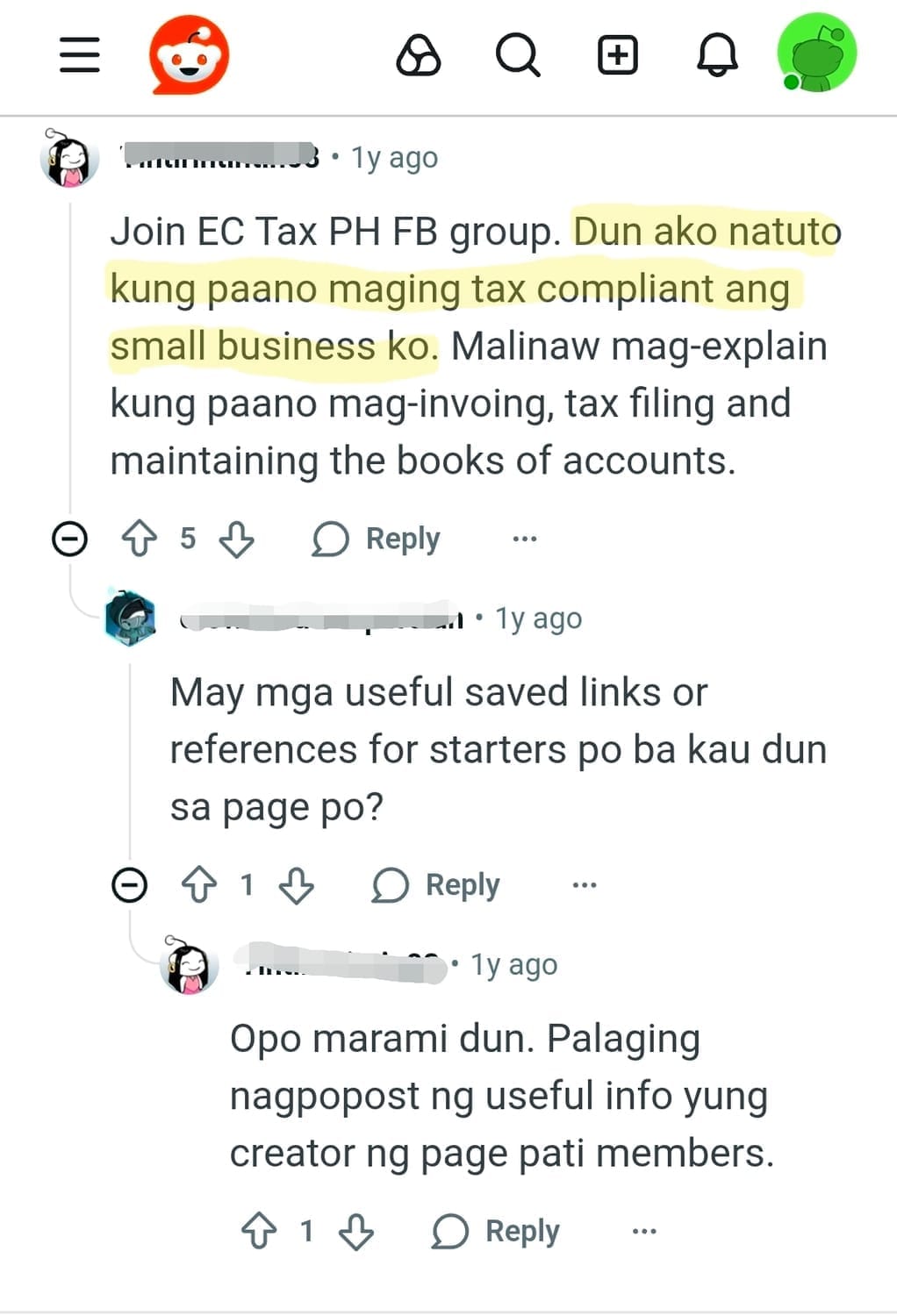

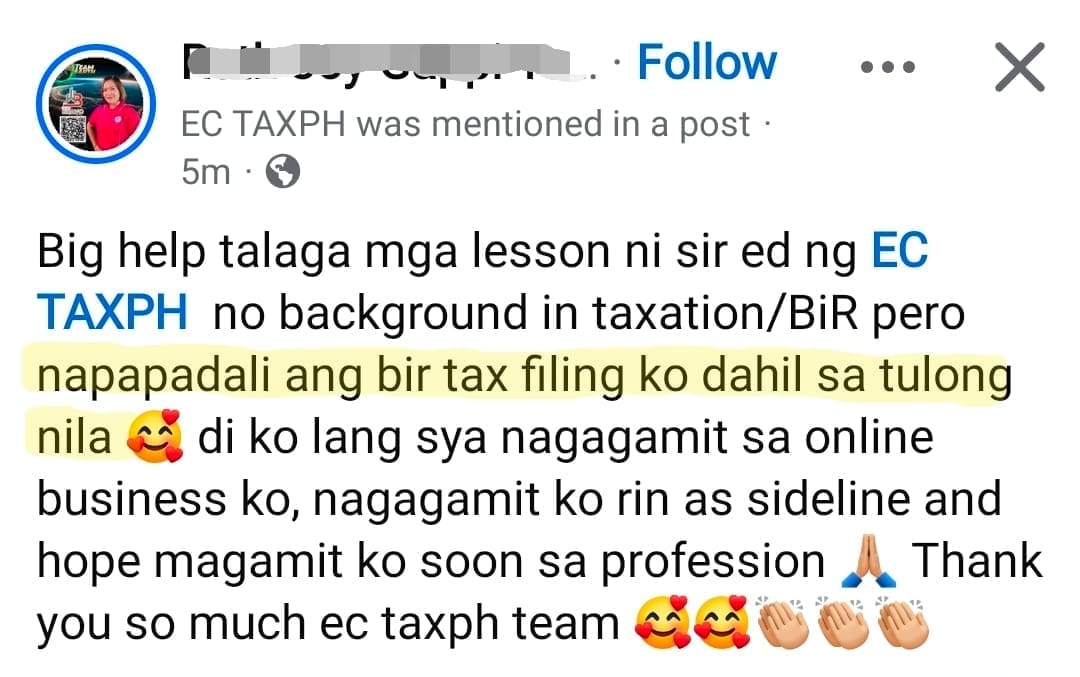

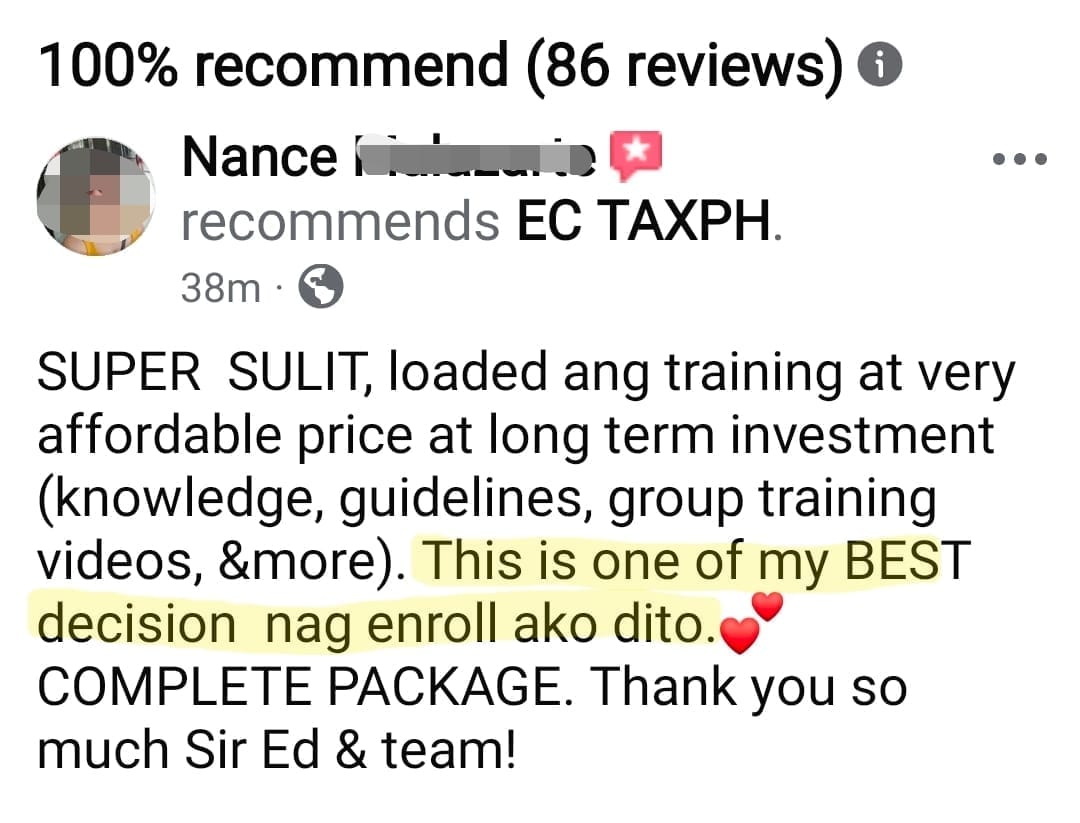

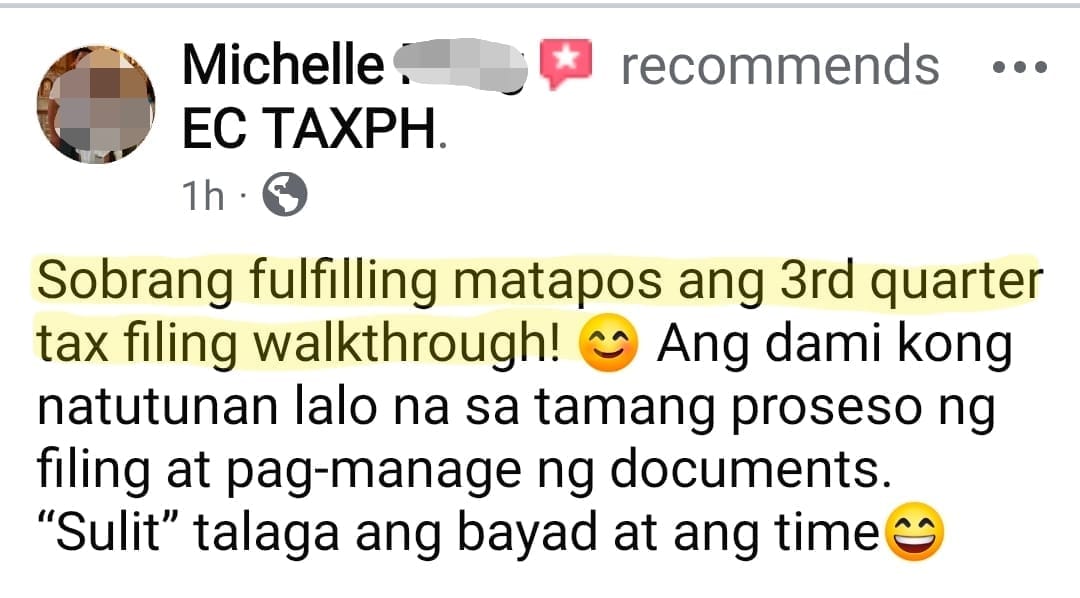

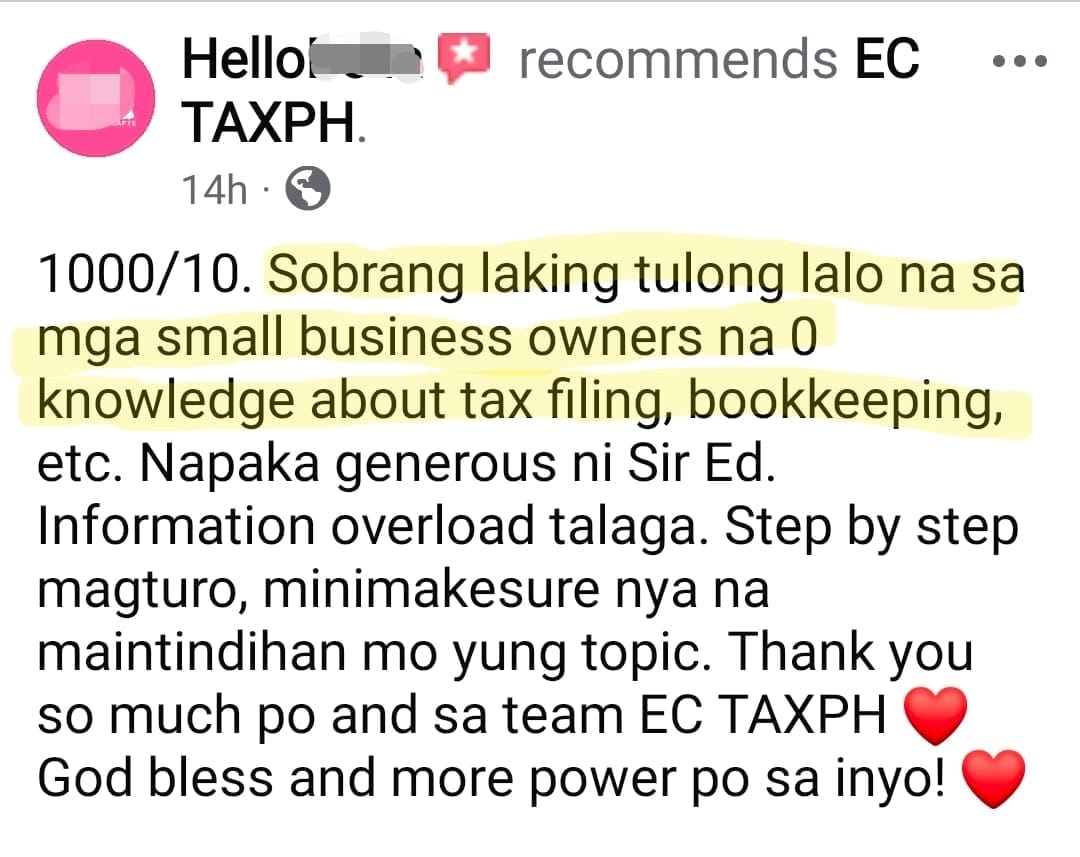

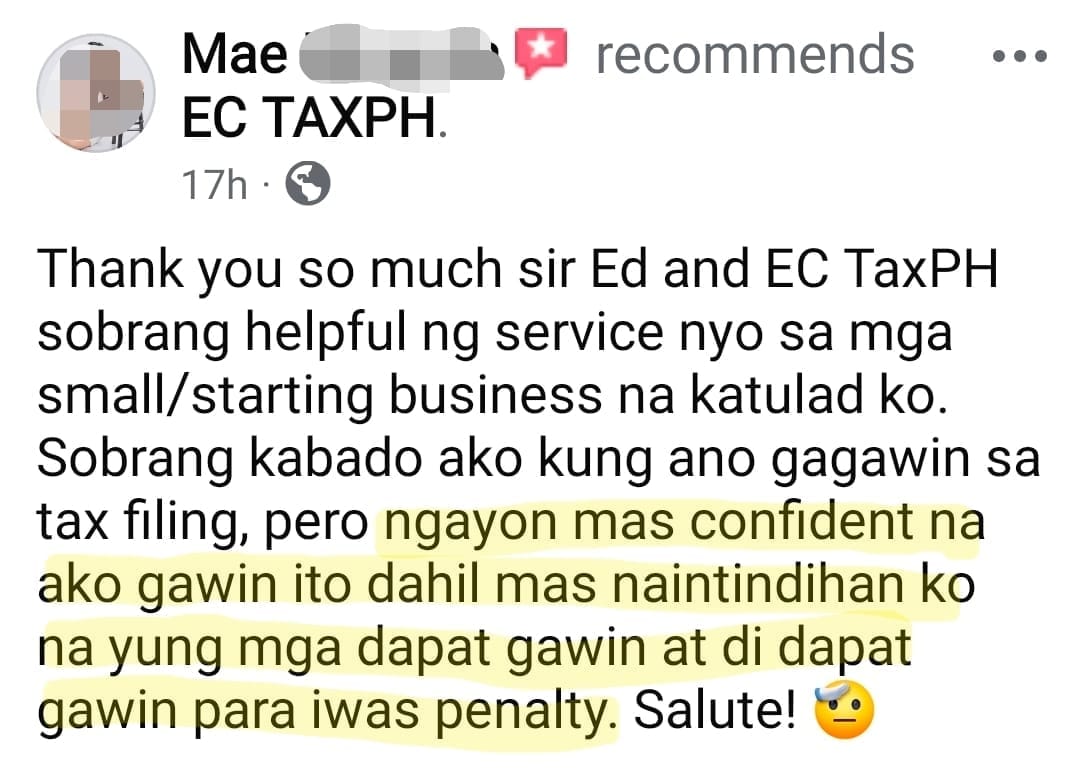

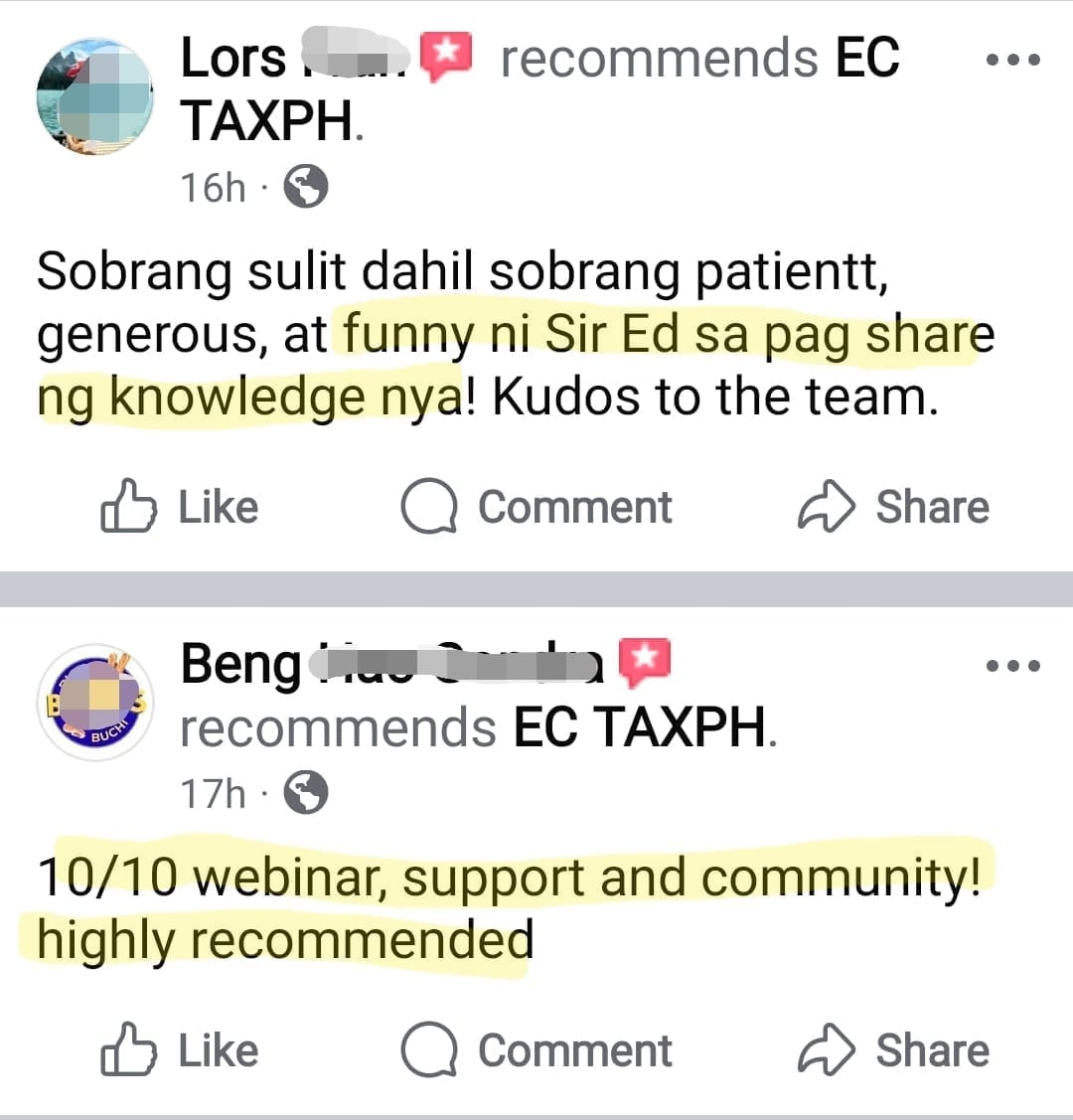

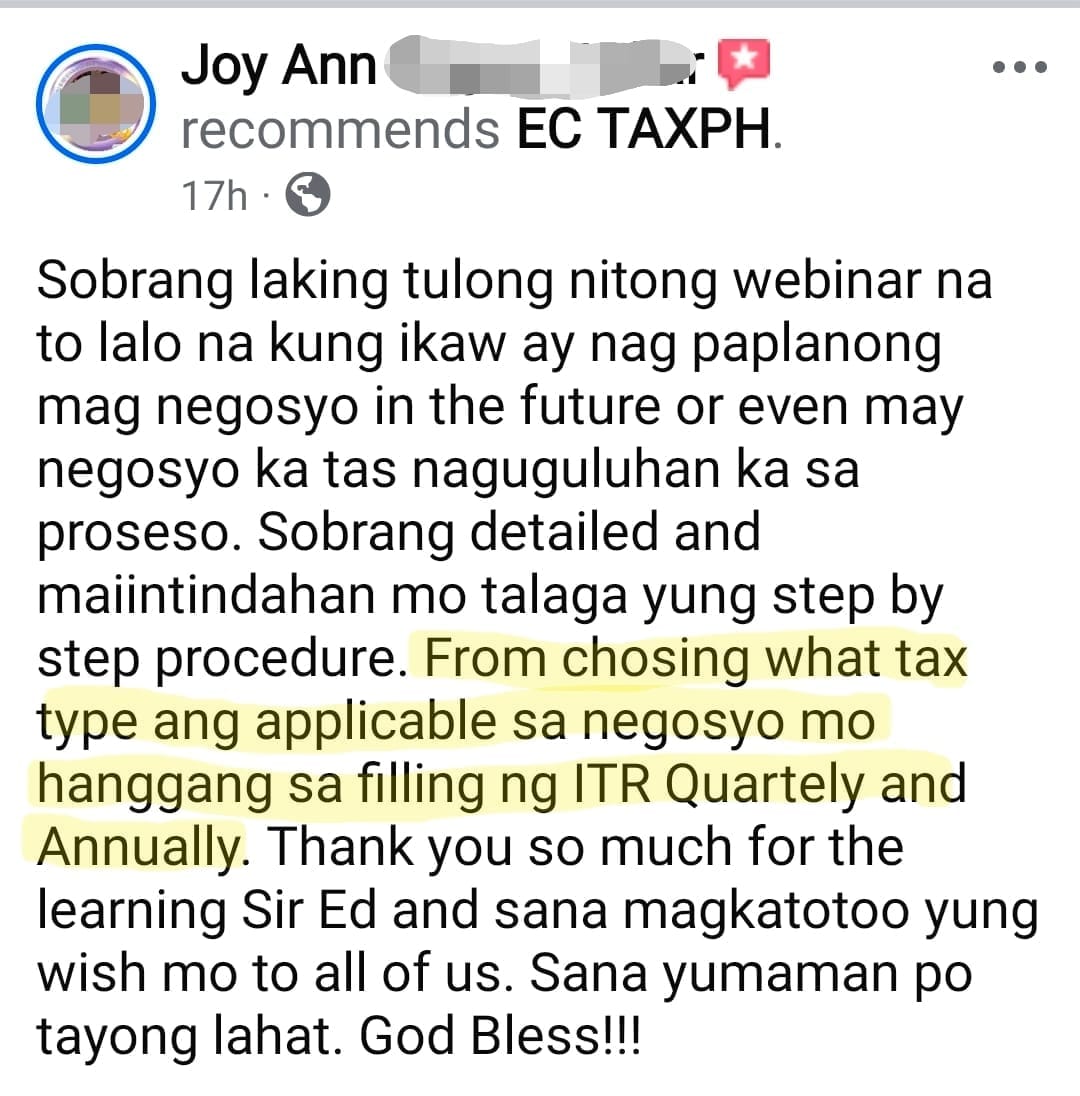

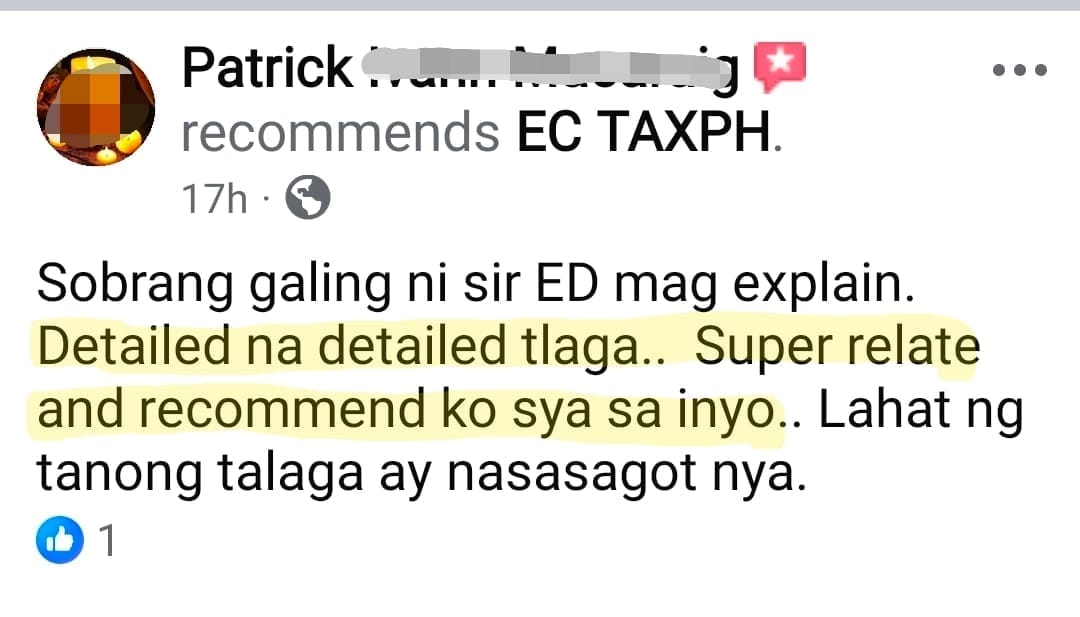

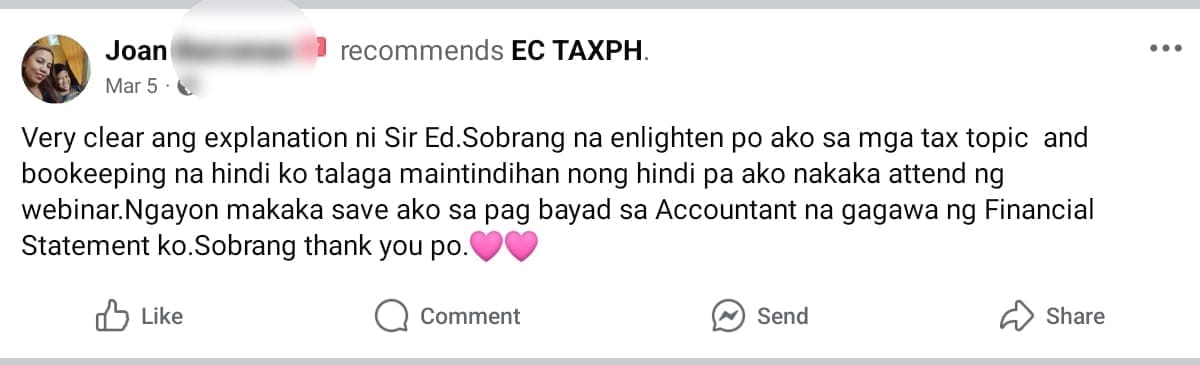

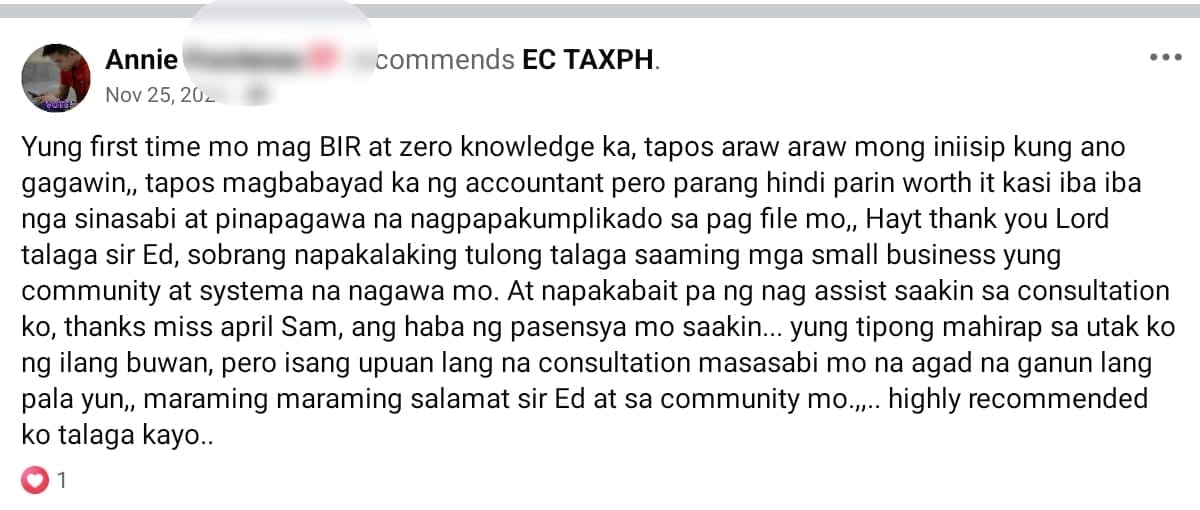

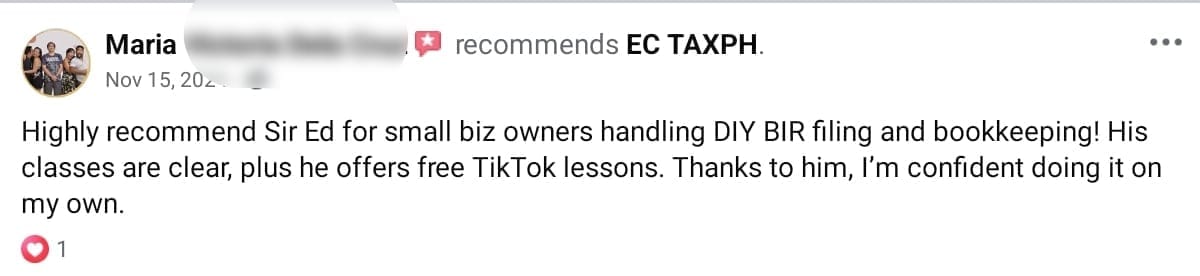

Yes! Ganyan ka-valuable ang

𝟯𝗥𝗗 𝗤𝗨𝗔𝗥𝗧𝗘𝗥 𝗧𝗔𝗫 𝗙𝗜𝗟𝗜𝗡𝗚 𝗪𝗔𝗟𝗞𝗧𝗛𝗥𝗢𝗨𝗚𝗛!

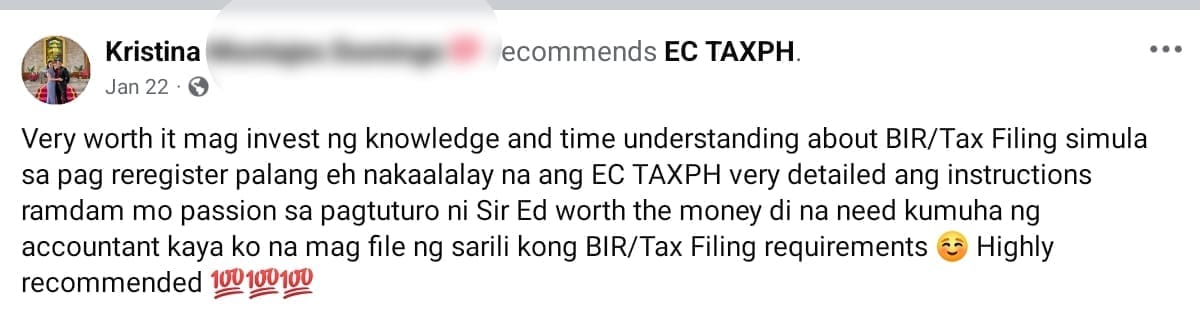

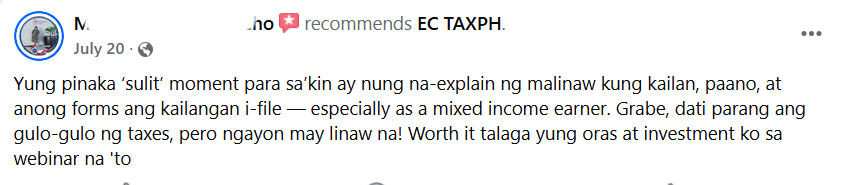

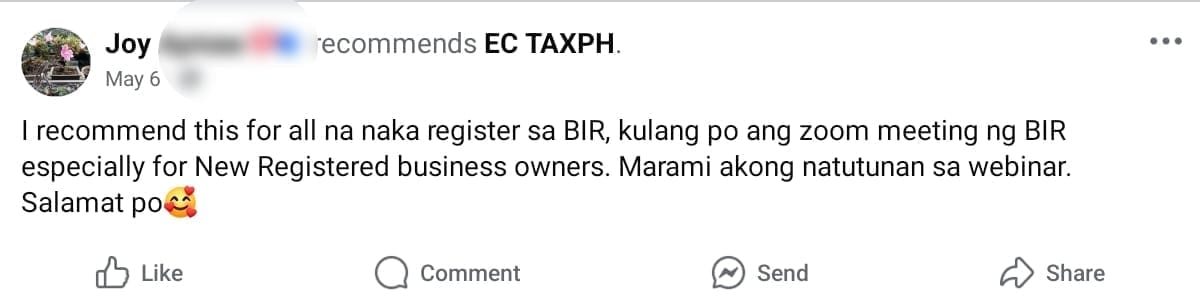

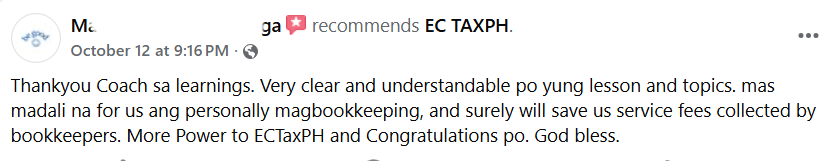

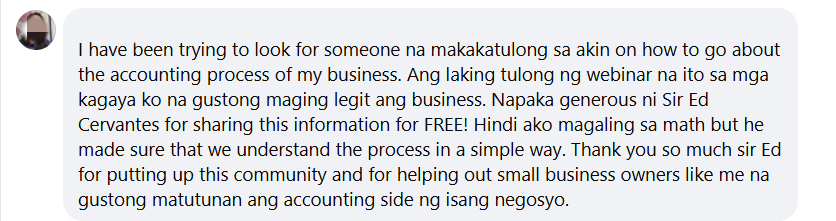

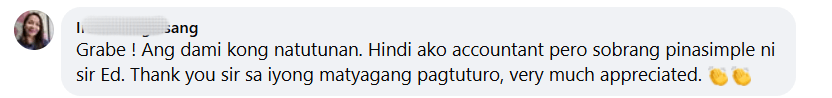

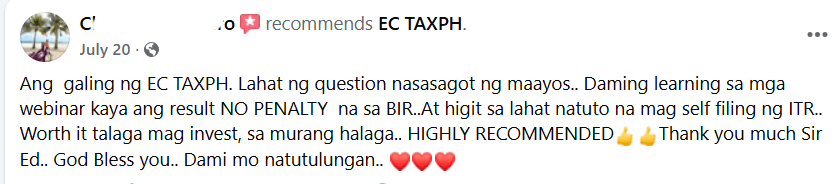

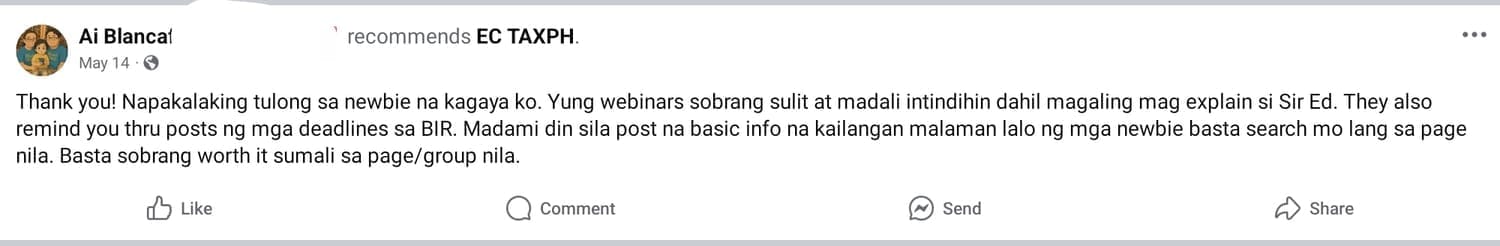

For the past year, thousands of students na ang nag-tiwala at nag-benefit sa mga trainings na ito. Providing expert guidance na pwede mong mapakinabangan.

Past attendees have seen real results, and this walkthrough is designed to help you do the same.

S**dy Is***o

"So very helpful para sa akin. Ilang days ako hindi pinatulog at kung kani kanino ako lumapit to seek help pero puro advised nila ibayad ko na lang..since accounting graduate din naman ibang profession lang nalinyahan ko ..gusto ko sana ako na lang para makatipid kami sa professional fee pero outdated na kasi un iba kong nalalaman good thing nakita ko ito sa FB...hindi kahina hinayang un fee for this webinar..parang Sir Ed pa nga ata lugi..."

Jan**e De G****n

"Ang swerte naming mga small ol/bussines owner kasi may isang Sir Ed Cervantes📷 very patient and considerate person.Napaka bait super linaw ng turo at paliwanag,worth it ang pag invest sa knyang webinar sobrang daming benefits .."

S*m P***er

"Very worth it mag invest ng knowledge and time understanding about BIR/Tax Filing simula sa pag reregister palang eh nakaalalay na ang EC TAXPH very detailed ang instructions ramdam mo passion sa pagtuturo ni Sir Ed worth the money di na need kumuha ng accountant kaya ko na."

Imagine wala kang background sa accounting, total newbie, zero knowledge, tapos natutunan mong mag-file and pay ng sarili mong tax.

How cool is that?

I'll be super proud of you!

NOTE: Limited lang yung slots na tatanggapin ko para sa recordings access.

Registration will close tonight at 11:59PM

Yes! Ganyan ka-valuable ang

𝟯𝗥𝗗 𝗤𝗨𝗔𝗥𝗧𝗘𝗥 𝗧𝗔𝗫 𝗙𝗜𝗟𝗜𝗡𝗚 𝗪𝗔𝗟𝗞𝗧𝗛𝗥𝗢𝗨𝗚𝗛!

For the past year, thousands of students na ang nag-tiwala at nag-benefit sa mga trainings na ito. Providing expert guidance na pwede mong mapakinabangan.

Past attendees have seen real results, and this walkthrough is designed to help you do the same.

S**dy Is***o

"So very helpful para sa akin. Ilang days ako hindi pinatulog at kung kani kanino ako lumapit to seek help pero puro advised nila ibayad ko na lang..since accounting graduate din naman ibang profession lang nalinyahan ko ..gusto ko sana ako na lang para makatipid kami sa professional fee pero outdated na kasi un iba kong nalalaman good thing nakita ko ito sa FB...hindi kahina hinayang un fee for this webinar..parang Sir Ed pa nga ata lugi..."

Jan**e De G****n

"Ang swerte naming mga small ol/bussines owner kasi may isang Sir Ed Cervantes📷 very patient and considerate person.Napaka bait super linaw ng turo at paliwanag,worth it ang pag invest sa knyang webinar sobrang daming benefits .."

S*m P***er

"Very worth it mag invest ng knowledge and time understanding about BIR/Tax Filing simula sa pag reregister palang eh nakaalalay na ang EC TAXPH very detailed ang instructions ramdam mo passion sa pagtuturo ni Sir Ed worth the money di na need kumuha ng accountant kaya ko na."

Imagine wala kang background sa accounting, total newbie, zero knowledge, tapos natutunan mong mag-file and pay ng sarili mong tax.

How cool is that?

I'll be super proud of you!

NOTE: Limited lang yung slots na tatanggapin ko para sa recordings access.

Registration will close tonight

at 11:59PM

Hi, I'm Ed Cervantes!

Certified Public Accountant, 2013

Master in Business Administration, 2016

US Certified Management Accountant, 2017

Certified Bookkeeper, 2019

Certified Tax Technician, 2021

10 years of teaching experience as a college professor

4 years of extensive Tax and Accounting Practice

BIR Accredited Tax Practitioner

Cooperative Development Authority (CDA) Accredited External Auditor

Certified Public Accountant, 2013

Master in Business Administration, 2016

US Certified Management Accountant, 2017

Certified Bookkeeper, 2019

Certified Tax Technician, 2021

10 years of teaching experience as a college professor

4 years of extensive Tax and Accounting Practice

BIR Accredited Tax Practitioner

Cooperative Development Authority (CDA) Accredited External Auditor

Hi, I'm Ed Cervantes!

10 years of teaching experience as a college professor

4 years of extensive Tax and Accounting Practice

BIR Accredited Tax Practitioner

Cooperative Development Authority (CDA) Accredited External Auditor

In 2020, I started my own accounting firm and established EC TAXPH.

My goal is to help business owners comply with BIR requirements and save money on taxes legally.

But more than that, my vision is to build a community that gives hope and confidence to small business owners - especially those who think starting a legal business is too expensive, too complicated, or only for those who can afford an accountant.

Through EC TAXPH, I want to empower micro-entrepreneurs to start right, learn how to register, issue invoices, do bookkeeping, and file taxes - even without an accounting background.

Because I believe that when more Filipinos understand compliance, more small businesses will thrive instead of close down out of fear or confusion.

Since May 2024, I've helped over 8,000 online sellers and freelancers learn how to file and pay their own taxes, even with zero accounting background.

I created webinars focusing on simplified tax filing and bookkeeping - helping them avoid penalties and focus on growing their business.

Together, we’re building a movement that makes tax compliance and bookkeeping easier, more accessible, and more empowering for every Filipino entrepreneur.

In 2020, I started my own accounting firm and established EC TAXPH.

My goal is to help business owners comply with BIR requirements and save money on taxes legally.

But more than that, my vision is to build a community that gives hope and confidence to small business owners - especially those who think starting a legal business is too expensive, too complicated, or only for those who can afford an accountant.

Through EC TAXPH, I want to empower micro-entrepreneurs to start right, learn how to register, issue invoices, do bookkeeping, and file taxes - even without an accounting background.

Because I believe that when more Filipinos understand compliance, more small businesses will thrive instead of close down out of fear or confusion.

Since May 2024, I've helped over 8,000 online sellers and freelancers learn how to file and pay their own taxes, even with zero accounting background.

I created webinars focusing on simplified tax filing and bookkeeping - helping them avoid penalties and focus on growing their business.

Together, we’re building a movement that makes tax compliance and bookkeeping easier, more accessible, and more empowering for every Filipino entrepreneur.

Frequently asked questions!

What if meron pa akong hindi maintindihan after ko mapanuod yung recorded trainings?

Don't worry, kasi meron kang 3 months exclusive support. Pwede ka magtanong unlimited follow-up questions anytime. Within 24 hours ia-assist ka ng team namin except weekends and holidays.

Wala pa talaga ako idea at experience sa tax filing, pwede ba sakin ito?

Yes. Designed talaga ang training na to para sa newbie or walang accounting background.

Applicable ba ito kahit hindi ako online seller?

Yes, pwede. Online sellers, freelancers, professionals, service-based business, physical store, & bookkeepers. Non-VAT 8%, 3% OSD, 3% Itemized including BMBE and mixed income earners. Php 3 Million or less sales per year. Basta willing ka matuto, magiging valuable ang training na to sayo.

Hanggang kelan ko pwede ma-access yung recorded trainings?

LIFETIME ACCESS ang recorded trainings, pwede mo panoorin anytime and anywhere kung kelan ka available.

Frequently asked questions!

What if meron pa akong hindi maintindihan after ko mapanuod yung recorded trainings?

Don't worry, kasi meron kang 3 months exclusive support. Pwede ka magtanong unlimited follow-up questions anytime. Within 24 hours ia-assist ka ng team namin except weekends and holidays.

Wala pa talaga ako idea at experience sa tax filing, pwede ba sakin ito?

Yes. Designed talaga ang training na to para sa newbie or walang accounting background.

Applicable ba ito kahit hindi ako online seller?

Yes, pwede. Online sellers, freelancers, professionals, service-based business, physical store, & bookkeepers. Non-VAT 8%, 3% OSD, 3% Itemized including BMBE and mixed income earners. Php 3 Million or less sales per year. Basta willing ka matuto, magiging valuable ang training na to sayo.

Hanggang kelan ko pwede ma-access yung recorded trainings?

LIFETIME ACCESS ang recorded trainings, pwede mo panoorin anytime and anywhere kung kelan ka available.

This is your last chance to finally file calmly, correctly, and on time, without fear, confusion, and penalties.

Naniniwala ako na kaya mo ‘to.

Pero gawin na natin ngayon, habang may oras pa, para iwas panic.

Let’s do this step-by-step, together!

Sana yumaman tayong lahat!

This is your last chance to finally file calmly, correctly, and on time, without fear, confusion, and penalties.

Naniniwala ako na kaya mo ‘to.

Pero gawin na natin ngayon, habang may oras pa, para iwas panic.

Let’s do this step-by-step, together!

Sana yumaman tayong lahat!

Contact Details:

3rd Floor FOG BLDG.

De Gala Street Corner,

Brgy. Poblacion

Candelaria, Quezon

+63 917 371 8864

Office Hours:

Monday to Friday

9:00 am to 4:00 pm

Closed on Weekends

Contact Details:

3rd Floor FOG BLDG. De Gala Street Corner, Brgy. Poblacion Candelaria, Quezon

+63 917 371 8864

Office Hours:

Monday to Friday

9:00 am to 4:00 pm

Closed on Weekends

Follow us on :

Here's how to secure your slot now:

STEP 1. Pay Php 899 (save 55%).

You can pay via GCash or bank transfer :

GCash: 09173718664

Ed J B

BPI: 8830005073

EC TAXPH Business Consultancy

STEP 2. i-PM mo lang yung proof of payment sa EC TAXPH Facebook page.

IMPORTANT NOTE: 𝗪𝗲 𝘄𝗶𝗹𝗹 𝘃𝗲𝗿𝗶𝗳𝘆 𝘆𝗼𝘂𝗿 𝗽𝗮𝘆𝗺𝗲𝗻𝘁 𝘄𝗶𝘁𝗵𝗶𝗻 𝟮𝟰 𝗵𝗼𝘂𝗿𝘀 and 𝗽𝗹𝗲𝗮𝘀𝗲

𝘄𝗮𝗶𝘁 𝗳𝗼𝗿 𝗼𝘂𝗿 𝗿𝗲𝗽𝗹𝘆 para ma-assist ka namin papunta sa exclusive group.

Here's how to secure your slot now:

STEP 1. Pay Php 899 (save 55%).

You can pay via GCash or bank transfer :

GCash: 09173718664

Ed J B

BPI: 8830005073

EC TAXPH Business Consultancy

STEP 2. i-PM mo lang yung proof of payment sa EC TAXPH Facebook page.

IMPORTANT NOTE: 𝗪𝗲 𝘄𝗶𝗹𝗹 𝘃𝗲𝗿𝗶𝗳𝘆 𝘆𝗼𝘂𝗿 𝗽𝗮𝘆𝗺𝗲𝗻𝘁 𝘄𝗶𝘁𝗵𝗶𝗻 𝟮𝟰 𝗵𝗼𝘂𝗿𝘀 and 𝗽𝗹𝗲𝗮𝘀𝗲 𝘄𝗮𝗶𝘁 𝗳𝗼𝗿 𝗼𝘂𝗿 𝗿𝗲𝗽𝗹𝘆 para ma-assist ka namin papunta sa exclusive group.